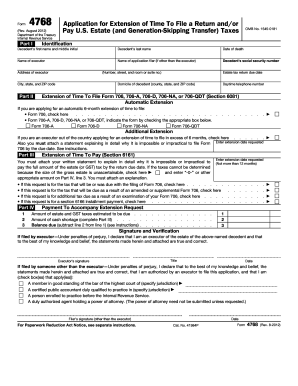

Get Irs 4768 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 4768 online

How to fill out and sign IRS 4768 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

If you aren't associated with document management and legal procedures, filling out IRS forms will be exceedingly challenging.

We recognize the significance of accurately filling out paperwork.

Using our service can certainly facilitate the professional completion of IRS 4768. We will handle everything for your convenience and ease.

- Click the button Get Form to access it and begin editing.

- Complete all required fields in the document using our sophisticated PDF editor. Activate the Wizard Tool to make the process even more straightforward.

- Verify the accuracy of the entered information.

- Add the date when filling out IRS 4768. Utilize the Sign Tool to generate a personal signature for the document validation.

- Finish editing by clicking Done.

- Transmit this document directly to the IRS in the most convenient manner for you: through email, by digital fax, or postal service.

- You have the option to print it on paper if a physical copy is necessary and download or store it in your chosen cloud storage.

How to modify Get IRS 4768 2012: personalize forms online

Choose a trustworthy document editing service you can rely on. Alter, finalize, and sign Get IRS 4768 2012 securely online.

Frequently, handling documents like Get IRS 4768 2012 can be a hassle, particularly if you received them online or via email without access to specific tools. While you might discover some alternatives to navigate through it, you could end up with a document that won't meet submission standards. Using a printer and scanner isn't a solution either, since it consumes time and resources.

We offer a more fluid and efficient method for completing files. A broad selection of document templates that are easy to modify and authorize, and then make fillable for selected individuals. Our approach goes well beyond merely a collection of templates. One of the key advantages of using our services is the ability to edit Get IRS 4768 2012 directly on our platform.

As it is a web-based platform, it eliminates the need for downloading any software on your computer. Additionally, not all company policies allow you to install it on your office laptop. Here’s the simplest way to effortlessly and securely finalize your documents with our solution.

Bid farewell to paper and other ineffective methods for completing your Get IRS 4768 2012 or other documents. Utilize our tool instead, which features one of the most extensive libraries of ready-to-customize templates and robust document editing services. It’s straightforward and secure, potentially saving you a significant amount of time! Don't just take our word for it, try it out yourself!

- Click the Get Form > and you’ll be instantly directed to our editor.

- Once opened, you can start the customization process.

- Select checkmark or circle, line, arrow, and cross and other options to annotate your document.

- Choose the date field to input a specific date into your template.

- Insert text boxes, images, notes, and more to enhance the content.

- Utilize the fillable fields option on the right to create fillable {fields.

- Select Sign from the upper toolbar to produce and generate your legally-binding signature.

- Click DONE to save, print, and distribute or download the document.

Get form

Related links form

While not always mandatory, an estate tax closing letter can be important when finalizing an estate. It gives assurance that the estate has met its tax obligations, which can ease any concerns from heirs or financial institutions. Consulting IRS 4768 can help determine whether this letter is essential for your specific situation.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.