Loading

Get Canada Gst62 E 2002

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada GST62 E online

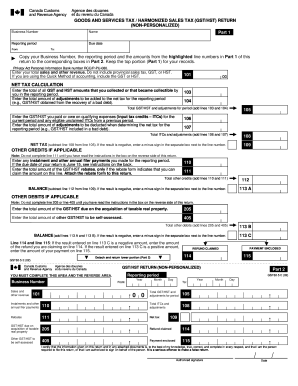

The Canada GST62 E is an essential form for businesses reporting their goods and services tax or harmonized sales tax. This guide provides a straightforward approach to completing the form online, ensuring that you accurately input your information for timely submissions.

Follow the steps to complete the Canada GST62 E form accurately.

- Press the ‘Get Form’ button to retrieve the Canada GST62 E form and open it within your preferred document management tool.

- Input your Business Number, name, and address in the designated fields at the top of the form. Ensure this information is accurate as it identifies your business.

- For the reporting period, enter the start and end dates. This specifies the timeframe for which you are reporting your GST/HST.

- In Part 1, provide your total sales and other revenue amounts. Exclude any provincial sales tax, GST, or HST from this entry.

- Calculate the net tax by entering the total GST/HST collected during the reporting period in the appropriate field.

- Input any adjustments for the net tax based on your reporting period, such as the recovery from bad debts.

- Follow with entries for input tax credits. These are amounts of GST/HST you paid on qualifying expenses that you can claim back.

- Claim any other applicable credits by entering values as instructed. These may include instalments made during the reporting period.

- Calculate and enter your balance by following the instructions for subtracting or adding the necessary amounts. Indicate any amounts claimed for refunds accurately.

- Complete the signature section, certifying that the information provided is accurate. This ensures your submission is legally valid.

- Finally, save your changes and choose to download, print, or share the completed form as required.

Complete your Canada GST62 E form online to ensure compliance and streamline your reporting process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, Americans can receive a tax refund in Canada, specifically through GST claims. If you have made purchases while visiting Canada that included GST, you can apply to reclaim that tax. Ensure you follow the instructions associated with the Canada GST62 E to maximize your chances of a successful refund.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.