Loading

Get Irs 4419 2018

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 4419 online

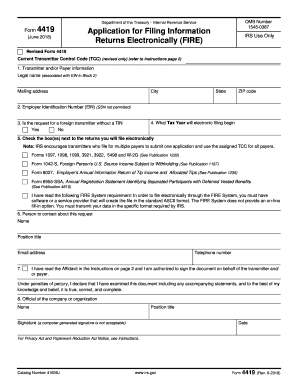

The IRS 4419 form is essential for organizations seeking authorization to electronically file various tax forms. This guide provides a concise, step-by-step approach to help users complete the form accurately and efficiently.

Follow the steps to successfully complete the IRS 4419 form.

- Select the ‘Get Form’ button to access the IRS 4419 form and open it in your preferred editor.

- In Block 1, enter the legal name associated with the Employer Identification Number (EIN) you are using. Fill in the complete mailing address, including city, state, and ZIP code.

- In Block 2, input the EIN of your organization. Please note that Social Security Numbers (SSN) are not accepted.

- Block 3 requires a check mark to indicate if your request is for a foreign transmitter without a Taxpayer Identification Number (TIN). Select ‘Yes’ or ‘No’.

- In Block 4, specify the tax year that you intend to begin electronic filing by entering the relevant year.

- Block 5 involves checking the boxes next to the returns you plan to file electronically. Ensure you only select the forms applicable to your organization.

- In Block 6, provide the contact details for a person knowledgeable about this application, including their name, position title, email address, and phone number.

- Block 7 requires you to confirm you have read the affidavit and that you are authorized to sign on behalf of the transmitter or payer. Ensure that all required fields are completed.

- In Block 8, provide the name and position title of the official who will sign the form. The signature must be hand-written; computer-generated signatures are not acceptable.

- After filling out all the blocks, review your entries for accuracy. You can then choose to save changes, download a copy, print, or share the completed form as needed.

Complete your IRS 4419 form online today and ensure a smooth electronic filing process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To speak with a live person at the IRS, dial 1-800-829-1040 and follow the prompts to connect with an agent. Remember that call volumes can be high, so patience is key. Having all your pertinent tax information ready will make the conversation more efficient.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.