Loading

Get Irs 2290 Due Dates 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 2290 Due Dates online

Navigating the IRS 2290 form can be straightforward if you understand its components and due dates. This guide will assist you in filling out the IRS 2290 for Heavy Vehicle Use Taxes online, ensuring you meet all necessary requirements efficiently.

Follow the steps to complete the IRS 2290 form effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Identify the tax year for which you are filing. Ensure that you are filling out the correct IRS 2290 form relevant to the current tax period.

- Locate the section where you will list each vehicle that requires a Heavy Vehicle Use Tax. Ensure to have the vehicle identification numbers (VINs) ready.

- For each vehicle listed, select the first month of use. This selection will determine the corresponding due date for the tax.

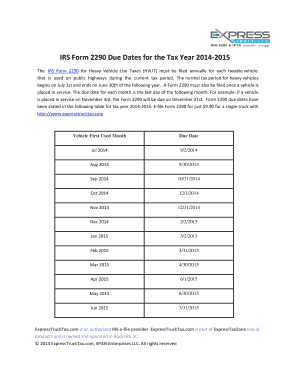

- Review the IRS 2290 due dates table based on the month you first used the vehicle. Ensure that you are aware of the deadline to avoid penalties.

- Complete any additional sections required by the form, including calculations for the tax amount based on the vehicle's gross weight.

- Once you have filled out all required fields, thoroughly review your entries for accuracy.

- Save your changes, then download, print, or share the completed form as needed for your records or submission.

Begin your online filing process for the IRS 2290 form today to ensure timely compliance.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To calculate the tax for IRS Form 2290, you typically multiply the gross weight of your vehicle by the tax rate, which is subject to change. It’s essential to refer to the IRS guidelines for the specific rates applicable during your filing year. You can also use tax calculators available on platforms like US Legal Forms to simplify the calculation process.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.