Get Irs 1120s - Schedule M-3 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1120S - Schedule M-3 online

This guide provides step-by-step instructions on how to accurately complete the IRS 1120S - Schedule M-3 online. It is designed for users of all experience levels, ensuring that everyone can successfully navigate the form.

Follow the steps to complete the IRS 1120S - Schedule M-3 online with ease.

- Click ‘Get Form’ button to obtain the form and open it in your chosen digital platform.

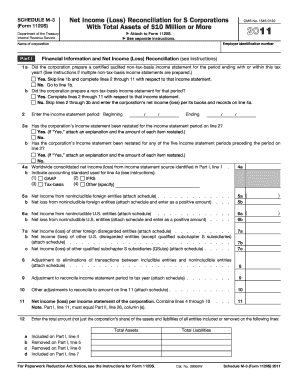

- Enter the employer identification number and name of the corporation at the top of the form.

- In Part I, answer whether the corporation prepared a certified audited non-tax-basis income statement for the period. If 'Yes', skip to line 2 after providing the necessary details; if 'No', proceed to line 1b.

- For lines 2 and 3, provide the income statement period. If the income statement has been restated, note that and attach an explanation with the amounts adjusted.

- Complete lines 4 through 10, which involve detailing worldwide consolidated net income, net income from foreign entities, and any necessary adjustments to reconcile to the net income per the income statement.

- In Part II, start reconciling net income (loss) reported in the income statement with total income (loss) per tax return, noting any temporary and permanent differences.

- Proceed to Part III to reconcile the expense and deduction items, similar to Part II, detailing U.S. current income tax expenses and any other pertinent itemized deductions.

- After completing all sections, review the entire form for accuracy and ensure all necessary schedules and attachments are included as required.

- Finally, save your changes, and use the option to download, print, or share the form as needed.

Complete your IRS 1120S - Schedule M-3 online today for an efficient tax reporting process.

Get form

Related links form

Schedule L on IRS Form 1120 provides a balance sheet for the corporation, detailing its assets, liabilities, and equity at the year’s end. This information is crucial for assessing the financial status of the corporation. By completing Schedule L accurately, businesses can ensure they present a clear picture of their financial health to the IRS and stakeholders alike. Utilizing resources like US Legal Forms can help navigate this process smoothly.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.