Loading

Get Or 735-32 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the OR 735-32 online

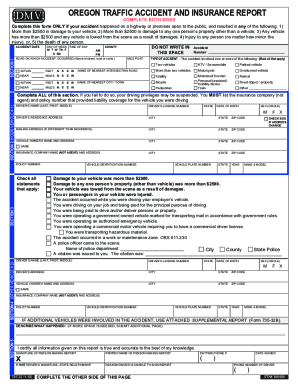

Filling out the Oregon Traffic Accident and Insurance Report (OR 735-32) can be a straightforward process when you know how to navigate its components. This guide provides step-by-step instructions to assist users in accurately completing the form online.

Follow the steps to successfully complete and submit the OR 735-32 form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Section 1, accurately provide the date, time, and location of the accident. Ensure you identify the county; if unsure, contact local law enforcement for clarity.

- Move to Section 2 and list your vehicle's details. Ensure to provide the correct insurance company name (not the agent) and policy number to avoid suspension of driving privileges.

- Complete Section 3 by answering all questions thoroughly. This helps DMV categorize the accident correctly. Understand the terms used, such as 'principal purpose of driving.'

- If there was another vehicle involved, fill out Section 4 with the other driver’s information. If more than two vehicles were involved, use the attached Supplemental Report (Form 735-32B).

- Describe the accident in Section 5. Provide detailed information about what happened, and make sure to sign and date the report at the designated areas.

- Complete any remaining sections on the other side of the form. Your full attention here can help in further assessments regarding transportation and road safety.

- Once you have completed both sides of the form, save the changes as needed. You can print it for your records or share it as necessary. If you want proof of submission, visit a DMV office with the form.

- Mail the completed form to the Accident Reporting Unit, DMV, at the specified address or fax it to the provided number.

Ensure you file the OR 735-32 online to stay compliant with Oregon laws regarding traffic accidents.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To file Ohio income tax, you need to complete the Ohio IT 1040 form, which is the state's individual income tax return. You can file either online using tax software or by mailing a paper return. Be sure to check for any applicable deductions and credits specific to Ohio, and stay informed about any updates through resources like OR 735-32 that may affect your tax filing.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.