Loading

Get Irs 1120s - Schedule K-1 2009

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1120S - Schedule K-1 online

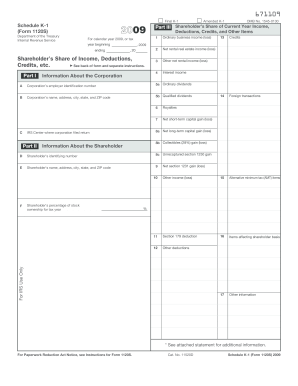

Filling out the IRS 1120S - Schedule K-1 can seem complex, but this guide will help you navigate the process online with ease. This document is crucial for reporting income, deductions, and credits to shareholders of S corporations.

Follow the steps to complete the IRS 1120S - Schedule K-1 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill out Part I, which contains information about the corporation. Enter the corporation’s employer identification number and full name, address, city, state, and ZIP code.

- In Part II, provide information about the shareholder. This includes the shareholder’s identifying number, and their full name, address, city, state, and ZIP code.

- Navigate to Part III, where you will detail the shareholder's share of income, deductions, and credits. Enter figures related to ordinary business income, rental real estate income, and other specified income or losses.

- Continue to fill in the various types of credits, foreign transactions, alternative minimum tax items, and other deductions as applicable to the shareholder’s situation, ensuring all entries comply with the related instructions.

- Review all entered information for accuracy, making sure each section is complete and correct.

- Once you have completed the form, you have the option to save your changes, download a copy, print the form, or share it directly as needed.

Complete your IRS 1120S - Schedule K-1 online today to ensure accurate reporting and compliance.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, K-1 distributions are considered income for the individual shareholders of the S-Corp. However, these distributions are reported differently depending on the adjusted basis. Each shareholder should be diligent in reporting this income on their personal tax returns. For clarity and support, uslegalforms offers great tools to help you understand these nuances.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.