Loading

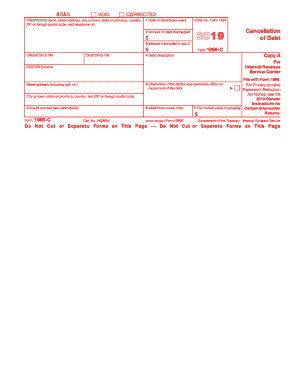

Get Irs 1099-c 2019-2025

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1099-C online

This guide provides a detailed overview of how to complete the IRS 1099-C form online. Whether you are a debtor or creditor, understanding the components of this form is essential for accurate reporting to the IRS.

Follow the steps to complete the IRS 1099-C form effectively.

- Press the ‘Get Form’ button to acquire the form and open it in your editor.

- Enter the creditor's name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone number in the designated fields.

- Input the date of the identifiable event in box 1. This should reflect the date the debt was discharged or an event that indicates a discharge.

- Fill in the amount of debt discharged in box 2. This figure must represent the actual or deemed discharged debt.

- If applicable, include any interest included in the debt in box 3.

- Provide the creditor's and debtor's taxpayer identification numbers (TIN) in the relevant boxes. For privacy, only the last four digits may be displayed.

- Describe the debt in box 4. If there is a property involved, include a description of that property as well.

- Indicate whether the debtor was personally liable for repayment of the debt in box 5 by checking the box if appropriate.

- Select the identifiable event code in box 6 that corresponds with the reason for the debt cancellation, as outlined in the instructions.

- If relevant, fill in the fair market value of the property in box 7. This may pertain to transactions involving property or foreclosure situations.

- After reviewing all entries for accuracy, save your changes and choose to download or print the form for your records. Additionally, consider sharing the form as required.

Complete your IRS 1099-C form online to ensure accurate tax reporting.

If you received an IRS 1099-C after filing your return, you might need to amend your tax return to include the canceled debt as income. It’s important to file this amendment as soon as possible to avoid future penalties. Consulting a tax professional is recommended for proper guidance on the amendment process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.