Loading

Get Irs 1120-reit 2016

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1120-REIT online

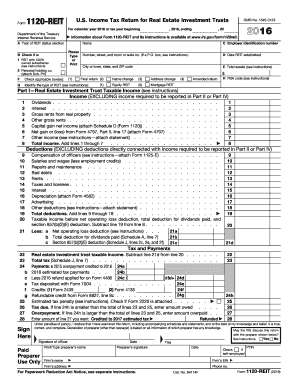

The IRS 1120-REIT is the U.S. Income Tax Return for Real Estate Investment Trusts. This guide will assist users in completing the form online with clear instructions for each section and field, ensuring compliance with IRS requirements.

Follow the steps to successfully complete the IRS 1120-REIT online.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Fill out the basic information. Enter the name, employer identification number, and address of the REIT. Ensure correctness and completeness of this information.

- Specify the REIT status election year and any applicable changes such as name, address, or if this is a final return.

- Complete Part I by reporting the income generated by the REIT. Ensure to accurately list all relevant income sources including dividends, interest, and gross rents.

- Move to the deductions section in Part I. List all allowable deductions related to your activities as a REIT, such as compensation of officers and interest paid.

- Determine taxable income by subtracting total deductions from the total income reported. Accurately calculate the final taxable income.

- Complete the tax and payments section to determine the total tax due or refund expected in relation to the taxes paid and overpayment credits.

- Sign and date the form, ensuring that all information is true and correct. If applicable, include the preparer’s details.

- Review all entries for accuracy. After confirming correctness, you can save your changes, download, print, or share the form as needed.

Start completing your IRS 1120-REIT online today to ensure timely and accurate filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

REIT dividends should be reported on your individual tax return, specifically on Form 1040, where you include them in your total income. More precisely, any dividend information received via Form 1099-DIV must be entered accurately. Consulting IRS 1120-REIT can provide additional insights into how dividends and distributions impact your overall tax obligations.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.