Get Irs 8867 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8867 online

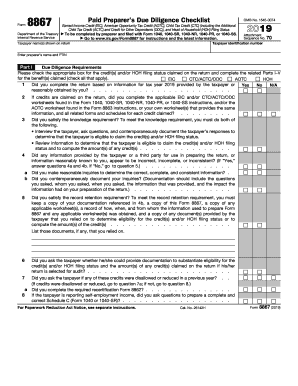

The IRS 8867, also known as the Paid Preparer’s Due Diligence Checklist, is a crucial form that tax preparers must submit to demonstrate compliance with due diligence requirements when claiming certain tax credits. This guide will walk you through the steps to fill out the form online, ensuring a comprehensive understanding of its components.

Follow the steps to fill out the IRS 8867 accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the taxpayer identification number and the taxpayer name(s) as shown on the return. Ensure that the information is accurate and corresponds to the individual's official documentation.

- Enter the preparer’s name and PTIN (Preparer Tax Identification Number), which are required fields.

- In Part I, select the credit(s) and/or Head of Household (HOH) filing status that are being claimed on the return. Check all applicable boxes corresponding to the Earned Income Credit (EIC), Child Tax Credit (CTC), American Opportunity Tax Credit (AOTC), and HOH.

- Answer all due diligence requirements questions in Part I. This section includes inquiries about information provided by the taxpayer, documentation retained, and inquiries made during the preparation process.

- Proceed to Part II if claiming EIC. Respond to questions assessing the eligibility of the taxpayer based on the child’s residency and any tiebreaker rules that might apply.

- Continue to Part III if claiming CTC, ACTC, or ODC. Verify the qualification of dependents and provide necessary explanations regarding eligibility.

- Complete Part IV if claiming AOTC. Ensure that the taxpayer has provided substantiation for the credit, including Form 1098-T as needed.

- Finish with Part V if claiming HOH. Confirm the taxpayer’s marital status and contribution to home costs.

- In Part VI, certify that the answers provided on the form are true and complete. Acknowledge that compliance is crucial, as failure to meet requirements may result in penalties.

- Once all sections are filled out, review the form for accuracy and completeness. Users can then save changes, download, print, or share the completed form.

Start completing your IRS 8867 online today to ensure compliance and accuracy in your tax filings.

Get form

IRS instruction booklets are available on the IRS website, where you can download and print the most current versions. These booklets provide detailed guidance on completing tax forms, including the IRS 8867. If you prefer obtaining a physical copy, contacting a local tax agency may be beneficial. Tools like uslegalforms can help you navigate this information smoothly.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.