Loading

Get Irs 8889 2019

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8889 online

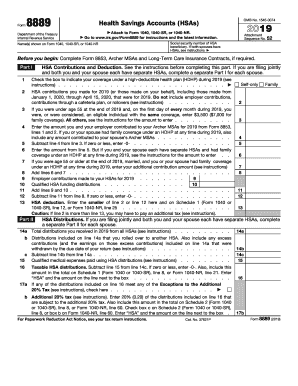

Filling out Form 8889 is an essential step for individuals who have Health Savings Accounts (HSAs). This guide provides a clear and supportive walkthrough of each section and field of the form to help users complete it accurately online.

Follow the steps to complete Form 8889 effectively.

- Click ‘Get Form’ button to access and open the IRS 8889 form in your preferred digital editor.

- Begin by entering the name(s) as shown on Form 1040, 1040-SR, or 1040-NR at the top of the form. Then, include the social security number of the HSA beneficiary if applicable.

- For Part I, check the box indicating your coverage under a high-deductible health plan (HDHP) during the tax year in question.

- Input the total HSA contributions made for the year, including those made from January 1, 2020, through the due date of your return, excluding any employer contributions.

- Complete the remaining lines in Part I to compute your HSA deduction, ensuring to carefully follow the instructions for calculating amounts based on your eligibility.

- Proceed to Part II by documenting the total distributions received from all HSAs during the tax year.

- Enter any amounts rolled over to another HSA or contributions withdrawn by the return due date, and then calculate any taxable distributions.

- Finally, in Part III, provide information regarding coverage and any additional tax for failure to maintain HDHP coverage, calculating total income from lines 18 and 19.

- Once all sections are filled out, ensure that all calculations are accurate before saving your changes. You can then download, print, or share your completed Form 8889.

Complete your documents online with confidence, ensuring all required forms are accurately filed.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

You do not need to report form 5498-SA on your tax return since it is for informational purposes only. This form shows contributions made to your HSA. However, it is crucial to keep it for your records, particularly when completing your IRS 8889.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.