Loading

Get Irs 1120 - Schedule D 2016

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1120 - Schedule D online

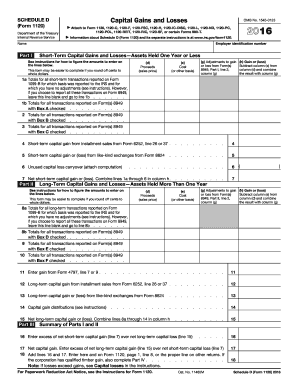

Filling out the IRS 1120 - Schedule D is an essential step for reporting capital gains and losses for corporations. This guide offers a clear and structured approach to completing the form online, ensuring users understand each component of the document.

Follow the steps to complete the IRS 1120 - Schedule D effectively.

- Click 'Get Form' button to access and download the IRS 1120 - Schedule D form in the online editor.

- Enter your employer identification number at the top of the form. This number is crucial for identifying your corporation.

- Fill in the name of the corporation as it appears on your tax documents.

- For Part I, input short-term capital gains and losses in the respective fields labeled (d) for proceeds, (e) for cost, (g) for adjustments, and (h) for calculated gain or loss.

- Continue through Part I, summarizing your short-term transactions as guided by the form's instructions. Ensure the totals for all relevant transactions are accounted for.

- Proceed to Part II, where you will report long-term capital gains and losses, following the same structure as Part I: (d) for proceeds, (e) for cost, (g) for adjustments, and (h) for gain or loss.

- Once all sections are filled, review all entries for accuracy and completeness.

- Upon final verification, you can save changes, download the document, print it for your records, or share it as necessary.

Begin completing your IRS 1120 - Schedule D online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Form 4797 refers to the document used to report the sale of business assets, including depreciable property. It specifically assists taxpayers in detailing the gain or loss made from the sale of these assets. Understanding Form 4797 is crucial for businesses, especially when considering the requirements of IRS 1120 - Schedule D for accurate tax reporting.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.