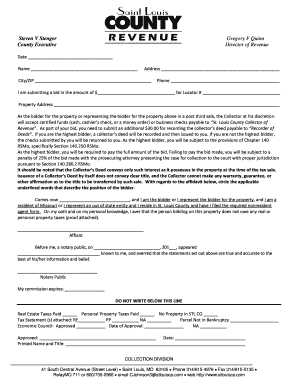

Get Mo Post Third Sale Bid Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign MO Post Third Sale Bid Form online

How to fill out and sign MO Post Third Sale Bid Form online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Nowadays, the majority of Americans prefer to handle their own income taxes and, additionally, to complete reports electronically.

The US Legal Forms online platform simplifies the process of e-filing the MO Post Third Sale Bid Form quickly and conveniently.

Ensure that you have accurately completed and submitted the MO Post Third Sale Bid Form on time. Consider any relevant deadlines. Providing incorrect information in your financial reports may lead to significant penalties and complications with your yearly tax return. Always utilize only professional templates with US Legal Forms!

- Access the PDF template in the editor.

- Refer to the designated fillable fields. This is where you should enter your information.

- Click the option to select if you encounter the checkboxes.

- Navigate to the Text icon along with other advanced features to manually edit the MO Post Third Sale Bid Form.

- Review all the information before you proceed to sign.

- Create your personalized eSignature using a keyboard, digital camera, touchpad, computer mouse, or smartphone.

- Verify your document online and specify the exact date.

- Click Done to continue.

- Save or send the document to the recipient.

How to Modify Get MO Post Third Sale Bid Form: Personalize Forms Online

Take advantage of the capabilities of the versatile online editor while completing your Get MO Post Third Sale Bid Form. Utilize a variety of tools to swiftly fill in the blanks and provide the necessary information in no time.

Drafting documents can be tedious and expensive unless you possess ready-made fillable forms that you can complete digitally. The optimal approach to manage the Get MO Post Third Sale Bid Form is to utilize our expert and multifaceted online editing solutions. We supply you with all the vital instruments for quick form completion and allow you to modify any aspects of your forms, tailoring them to your specific requirements. Furthermore, you can comment on the modifications and leave messages for other parties involved.

Here’s what you can accomplish with your Get MO Post Third Sale Bid Form in our editor:

Utilizing the Get MO Post Third Sale Bid Form in our robust online editor is the quickest and most efficient way to manage, submit, and share your paperwork as required from anywhere. The tool operates from the cloud, allowing you to access it from any location on any internet-enabled device. All forms you create or fill out are securely stored in the cloud, ensuring you can always retrieve them when necessary and feel assured of not losing them. Cease wasting time on manual document filling and eliminate physical paperwork; conduct everything online with minimal effort.

- Complete the fields using Text, Cross, Check, Initials, Date, and Sign tools.

- Emphasize essential details with a preferred color or underline them.

- Hide sensitive information using the Blackout tool or simply eliminate them.

- Insert images to illustrate your Get MO Post Third Sale Bid Form.

- Substitute the original text with content that meets your requirements.

- Add comments or sticky notes to engage with others regarding the updates.

- Insert additional fillable sections and designate them to specific recipients.

- Secure the document with watermarks, include dates, and bates numbers.

- Distribute the document in various manners and save it on your device or the cloud in different formats after making modifications.

Related links form

If your property is sold at a tax sale, you may lose ownership and must address the subsequent issues. This includes the possibility of a redemption period where the original owner can reclaim their property by paying the owed taxes. However, if they do not redeem the property, the new owner gains full rights. Understanding these processes through the MO Post Third Sale Bid Form is crucial for all parties involved.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.