Loading

Get Mo Form 8821 2014-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO Form 8821 online

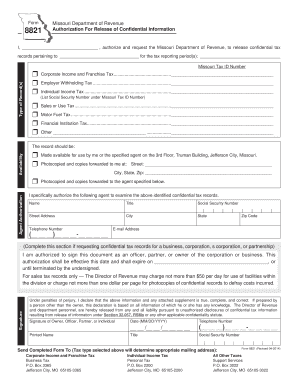

Filling out the MO Form 8821 online can simplify the process of authorizing the release of confidential tax information. This guide will walk you through each step, ensuring that you complete the form accurately and efficiently.

Follow the steps to complete the form successfully

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your personal information in the designated fields. This includes the name of the individual authorizing the release, as well as relevant details pertaining to the requested tax records.

- In the next section, specify the Missouri Tax ID Number and the types of records you wish to access. Indicate your choice by checking the appropriate boxes for Corporate Income and Franchise Tax, Employer Withholding Tax, Individual Income Tax, Sales or Use Tax, Motor Fuel Tax, Financial Institution Tax, or Other.

- Provide the tax reporting periods relevant to your request. Ensure that all required fields are completed to avoid processing delays.

- Authorize an agent, if applicable, by filling in their name, title, contact information, and the preferred method of accessing the records – whether they should be made available in person or sent to an address.

- Specify your role in relation to the business or corporation by identifying your position, such as an officer, partner, or owner. Confirm the authorization's effective date and the expiration date if applicable.

- Sign and date the document. This signature certifies that the information provided is true, complete, and correct. Include your printed name, title, telephone number, and Social Security Number where indicated.

- Finally, review the completed form for accuracy. Once satisfied, you can save changes, download, print, or share the form as needed. Make sure to send the completed form to the appropriate mailing address based on the type of tax record requested.

Complete your tax document filings online today for a more efficient process.

Related links form

To submit power of attorney to the IRS, you will need to complete IRS Form 2848. Fill out the required information accurately and send it directly to the IRS office specified in the form's instructions. It’s important to keep a copy of your submission for your records. For additional support when navigating these forms, uslegalforms can provide useful templates and advice tailored to your needs.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.