Get Ak Form 665 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AK Form 665 online

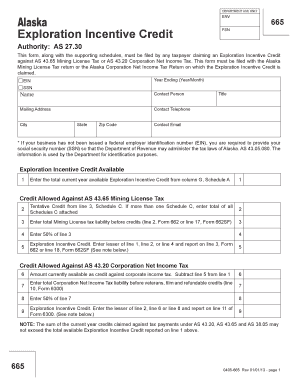

This guide provides clear instructions on filling out the AK Form 665, which is necessary for taxpayers claiming an Exploration Incentive Credit in Alaska. By following these steps, users can efficiently navigate the online process and ensure all required information is accurately submitted.

Follow the steps to complete the AK Form 665 online:

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Locate the Year Ending section and enter the applicable year and month for which you are claiming the credit.

- Fill in your Employer Identification Number (EIN) or Social Security Number (SSN) as necessary, along with your name and mailing address.

- Provide the contact person's name, telephone number, city, state, and zip code to ensure easy communication.

- Complete the Exploration Incentive Credit Available section by entering the total current year available Exploration Incentive Credit from Schedule A.

- In the Credit Allowed Against AS 43.65 Mining License Tax section, input the tentative credit from line 3, Schedule C.

- Input the total Mining License tax liability before credits in the designated line, and calculate 50% of this total.

- Determine the Exploration Incentive Credit by entering the lesser of the amounts calculated in the previous lines.

- Proceed to fill in the Credit Allowed Against AS 43.20 Corporation Net Income Tax section, following similar steps and calculations.

- Complete any additional required schedules, such as Schedule B and C, providing necessary details about previous credits claimed and income from mining operations.

- Review all entered information for accuracy and completeness before proceeding to save changes. You can then download, print, or share the completed form.

Complete your AK Form 665 online to take advantage of the Exploration Incentive Credit.

Get form

Related links form

Filling out a withholding exemption form involves providing information about your filing status and the number of exemptions you claim. Ensure that you accurately reflect your financial situation to avoid underpaying or overpaying taxes. It's essential to review these details regularly, especially after significant life changes. The AK Form 665 can help manage your withholding effectively and ensure compliance with IRS guidelines.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.