Loading

Get Ca Ftb 588 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 588 online

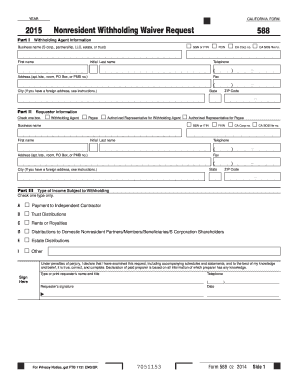

This guide provides detailed instructions on completing the CA FTB 588, Nonresident Withholding Waiver Request, online. By following these steps, you can efficiently navigate the form and ensure accurate submission.

Follow the steps to fill out the CA FTB 588 online effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Complete Part I with the withholding agent information: Enter the taxpayer identification number (SSN, ITIN, FEIN, or CA Corp No.), business name, contact number, address, and fax number.

- Fill out Part II with the requester information: Provide the necessary taxpayer identification number, business name, contact number, address, and fax number.

- In Part III, select the type of income subject to withholding by checking only one box that corresponds to the payment type — for instance, payment to independent contractor or rent.

- Proceed to Part IV, the Schedule of Payees: Enter the taxpayer identification number and details for each payee. If more than three payees exist, attach additional copies of the Schedule of Payees.

- Indicate the reason for the waiver request in Part IV by checking the appropriate letter code. If you choose Reason E, ensure to attach supporting documentation.

- Review all information for accuracy, sign the form where indicated, and enter the date.

- Once completed, save any changes, and if desired, download, print, or share the filled form as needed.

Begin filling out your CA FTB 588 online today to simplify your tax processes.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

When filling out the California resale certificate form, gather your business information, including your seller's permit number. Clearly list the type of goods purchased for resale, ensuring accuracy in every detail. Adhering to the CA FTB 588 guidelines helps maintain your compliance with state tax regulations.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.