Loading

Get Ak Form 6385 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AK Form 6385 online

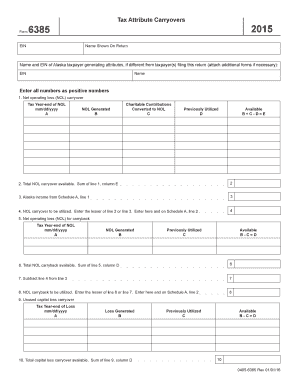

Filling out the AK Form 6385 online can streamline the process of reporting tax attribute carryovers for Alaska taxpayers. This guide provides clear, step-by-step instructions to assist users in completing the form accurately and efficiently.

Follow the steps to complete the AK Form 6385 online.

- Click ‘Get Form’ button to access the form and open it for editing.

- In the EIN field, enter your Employer Identification Number for the tax year. Ensure the information is accurate as it is essential for identification.

- In the 'Name Shown On Return' section, input the name and EIN of the person or business that generated the attributes if different from the filer. Attach additional forms if necessary.

- Fill out Section 1 for Net Operating Loss (NOL) carryover. Input the tax year-end of the NOL, followed by the various calculations for net operating loss generated and previously utilized. Calculate the available NOL carryover by entering the results in the designated field.

- Move to Section 2 to record the total NOL carryover available. This should be the sum of column E from line 1.

- In Section 3, document any Alaska income from Schedule A, line 1. This income will be used in subsequent calculations.

- Complete Section 4 by entering the lesser of the total NOL carryover or the Alaska income. Record this amount for Schedule A, line 2.

- Proceed to Section 5 to report the NOL for carryback. Fill in the relevant tax year-end of the NOL, generated NOL, and previously utilized NOL. Calculate the available carryback.

- Continue to Section 6 to sum the total NOL carryback available which is found in column D from Section 5.

- Subtract line 4 from line 3 in Section 7 to ascertain the remaining income.

- In Section 8, report the NOL carryback to be utilized by entering the lesser of the total available carryback or the remaining income.

- Complete the remaining sections related to capital loss and excess charitable contributions similarly, ensuring that all calculations and available balances are accurately recorded.

- Once all sections are filled in, review the form for accuracy. Users can save changes, download, print, or share the completed form as needed.

Complete your AK Form 6385 online today to ensure accurate tax reporting.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

A tax form with AK refers to any document that relates to tax filings or obligations in the state of Alaska. This includes forms like AK 40, AK 2, and, importantly, the AK Form 6385, which is vital for accurately reporting income and taxes. Using platforms like US Legal Forms can simplify your understanding and completion of these tax documents.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.