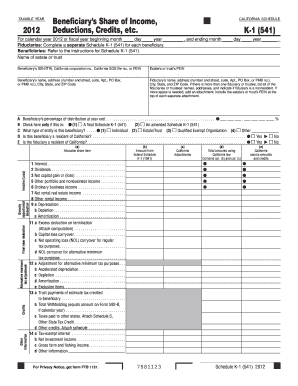

Get Ca Ftb 541 - Schedule K-1 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign CA FTB 541 - Schedule K-1 online

How to fill out and sign CA FTB 541 - Schedule K-1 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When the taxation phase commenced unexpectedly or you simply overlooked it, it may likely lead to issues for you.

CA FTB 541 - Schedule K-1 isn’t the simplest form, but you have no reason to be concerned regardless.

With our advanced digital solution and its useful tools, submitting CA FTB 541 - Schedule K-1 is simplified. Don’t hesitate to try it and spend more time on hobbies and interests rather than dealing with paperwork.

- Access the document using our robust PDF editor.

- Complete all necessary details in CA FTB 541 - Schedule K-1 by utilizing the fillable fields.

- Add images, check marks, selection boxes, and text boxes as needed.

- Repeated information will automatically populate after the initial entry.

- If you encounter any difficulties, activate the Wizard Tool for guidance to facilitate easier completion.

- Always remember to include the filing date.

- Create your personalized signature once and place it in the appropriate fields.

- Review the information you have entered. Make corrections if necessary.

- Click Done to finish editing and select your delivery method. You can opt for digital fax, USPS, or email.

- You can download the document to print later or store it in cloud services like Dropbox, OneDrive, etc.

How to modify Get CA FTB 541 - Schedule K-1 2012: personalize forms online

Place the correct document alteration features at your disposal. Complete Get CA FTB 541 - Schedule K-1 2012 with our reliable service that includes editing and eSignature options.

If you wish to execute and sign Get CA FTB 541 - Schedule K-1 2012 online effortlessly, then our online cloud-based solution is the perfect choice. We provide a comprehensive template library of pre-made documents that you can adjust and finish online. Additionally, there is no need to print the form or utilize external services to render it fillable. All essential tools will be readily accessible for your use once you access the file in the editor.

Let’s explore our online editing features and their essential characteristics. The editor features an intuitive interface, so it won’t require much time to learn how to operate it. We’ll examine three primary sections that enable you to:

In addition to the functionalities mentioned above, you can protect your file with a password, apply a watermark, convert the document to the required format, and much more.

Our editor makes finishing and certifying the Get CA FTB 541 - Schedule K-1 2012 incredibly simple. It allows you to accomplish nearly everything related to form management. Furthermore, we ensure that your experience with files is secure and adheres to major regulatory standards. All these factors enhance the enjoyment of using our solution.

Obtain Get CA FTB 541 - Schedule K-1 2012, make necessary edits and modifications, and acquire it in the preferred file format. Try it out today!

- Modify and annotate the template

- The top toolbar includes the tools that allow you to emphasize and obscure text, without images and visual elements (lines, arrows, checkmarks, etc.), sign, initialize, date the document, and more.

- Organize your documents

- Utilize the toolbar on the left if you wish to rearrange the document or delete pages.

- Make them distributable

- If you want to enable others to fill out the document and share it, you can use the tools on the right to add various fillable fields, signature and date, text box, etc.

Get form

Related links form

CA 541 Schedule K-1 refers to the specific form used in California to report taxpayers' share of income from partnerships and S corporations under California tax law. This form details your share of the partnership's earnings and losses, directly affecting your state income tax return. For assistance with filing, consider using uslegalforms for a smooth experience.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.