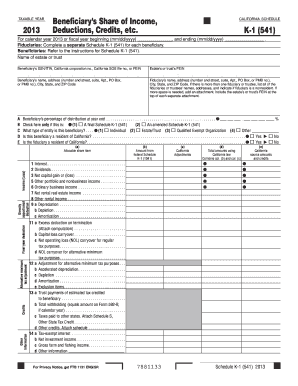

Get Ca Ftb 541 - Schedule K-1 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign CA FTB 541 - Schedule K-1 online

How to fill out and sign CA FTB 541 - Schedule K-1 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When the taxation period commenced unexpectedly or perhaps you simply overlooked it, it might potentially lead to issues for you. CA FTB 541 - Schedule K-1 is not the most straightforward one, but you have no reason to stress regardless.

Utilizing our robust solution, you will discover how to complete CA FTB 541 - Schedule K-1 in times of significant time scarcity. You just need to adhere to these basic instructions:

With our all-encompassing digital solution and its useful tools, filling out CA FTB 541 - Schedule K-1 becomes easier. Don’t hesitate to utilize it and enjoy more time on hobbies and interests instead of organizing documents.

Access the document in our expert PDF editor.

Input the necessary information in CA FTB 541 - Schedule K-1, using the fillable fields.

Incorporate images, checkmarks, verification boxes, and text boxes, as required.

Repeating data will be populated automatically after the initial entry.

If there are any confusions, activate the Wizard Tool. You will receive helpful hints for easier submission.

Always remember to include the application date.

Create your distinct signature once and place it in the required locations.

Review the information you have provided. Amend errors if necessary.

Select Done to finish editing and choose how you will submit it. There is an option to use virtual fax, USPS or e-mail.

You may also download the document for later printing or upload it to cloud storage like Google Drive, OneDrive, etc.

How to Modify Get CA FTB 541 - Schedule K-1 2013: Personalize Forms Online

Streamline your document preparation process and tailor it to your preferences with just a few clicks. Complete and endorse Get CA FTB 541 - Schedule K-1 2013 using a powerful yet intuitive online editor.

Drafting documents is frequently challenging, particularly when you encounter it sporadically. It necessitates that you strictly follow all procedures and correctly populate all fields with complete and precise information. Nonetheless, it often occurs that you need to amend the document or add additional fields to complete. If you aim to enhance Get CA FTB 541 - Schedule K-1 2013 before submission, the simplest approach is by utilizing our all-encompassing yet easy-to-navigate online editing tools.

This comprehensive PDF editing service allows you to swiftly and effortlessly finalize legal documents from any device with internet access, make essential modifications to the template, and add more fillable fields. The platform empowers you to select a specific area for each data category, such as Name, Signature, Currency, and SSN, among others. You can designate these as mandatory or optional, and determine who needs to fill each section by assigning them to a designated recipient.

Follow the steps outlined below to alter your Get CA FTB 541 - Schedule K-1 2013 online:

Our editor serves as a versatile, multi-functional online tool that can assist you in quickly and easily refining Get CA FTB 541 - Schedule K-1 2013 and other forms to meet your needs. Improve document preparation and submission time while ensuring your paperwork appears impeccable without complication.

- Access the required document from the directory.

- Complete the fields with Text and utilize Check and Cross features for the tick boxes.

- Use the right-side panel to adjust the form by adding new fillable sections.

- Select the fields based on the type of data you wish to gather.

- Set these fields as mandatory, optional, and conditional and customize their arrangement.

- Assign each section to a specific individual using the Add Signer feature.

- Verify that all necessary modifications have been made and click Done.

Get form

Yes, K-1 distributions are generally considered income and must be reported on your tax return. The CA FTB 541 - Schedule K-1 details this income flowing from partnerships or trusts to individuals. Accurately reporting it is important for compliance with tax legislation. Utilizing tax resources can help ensure you meet your filing requirements effectively.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.