Loading

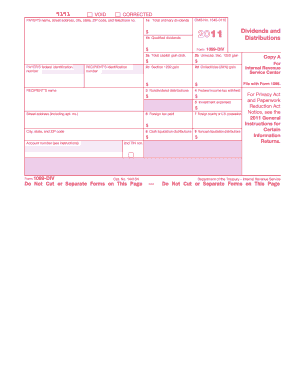

Get Irs 1099-div 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1099-DIV online

Filling out the IRS 1099-DIV form online can streamline reporting dividends and distributions effectively. This guide provides a structured approach to help users navigate each component of the form with confidence.

Follow the steps to complete the IRS 1099-DIV form online.

- Click ‘Get Form’ button to obtain the form and open it in your online editor.

- Enter the payer's name, street address, city, state, ZIP code, and telephone number in the designated fields.

- Fill in the payer's federal identification number.

- Input the recipient's name and their identification number.

- In Box 1a, enter the total ordinary dividends received.

- In Box 1b, record the amount of qualified dividends, if applicable.

- Input the total capital gain distributions in Box 2a.

- Complete Box 2b with any unrecaptured section 1250 gain.

- Include any section 1202 gain in Box 2c, if relevant.

- For collectibles gain, record in Box 2d.

- In Box 3, enter any nondividend distributions.

- Document any federal income tax withheld in Box 4.

- In Box 5, include any investment expenses incurred.

- Indicate any foreign taxes paid in Box 6.

- Fill in the foreign country or U.S. possession in Box 7.

- Input cash liquidation distributions in Box 8.

- Record noncash liquidation distributions in Box 9.

- After completing all fields, review the entries for accuracy, then save the changes, download, print, or share the form.

Complete your IRS 1099-DIV form online today to ensure accurate reporting.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To submit an IRS 1099-DIV, you have several options, with electronic filing being the fastest and most efficient method. You can use e-filing software or even paper forms if you prefer. Ensure you file the form by the required deadline to avoid possible penalties. If you need detailed assistance on the process, visit uslegalforms for step-by-step guidance.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.