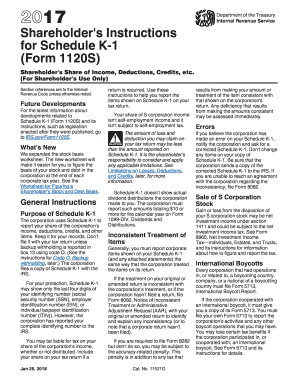

Get Irs Instruction 1120s - Schedule K-1 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the IRS Instruction 1120S - Schedule K-1 online

Filling out the IRS Instruction 1120S - Schedule K-1 online can seem daunting, but this guide simplifies the process. This form is essential for reporting a shareholder's share of income, deductions, credits, and other items from an S corporation.

Follow the steps to fill out the IRS Instruction 1120S - Schedule K-1 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your name and address in the designated fields to ensure proper identification.

- Fill in the boxes reflecting your share of the corporation's income, deductions, and credits as reported in the instructions provided for each box.

- Review all entered data for accuracy and ensure compliance with IRS guidelines before proceeding.

- At the end of the process, save your changes, and choose to download, print, or share the completed form as necessary.

Complete your IRS forms online today for a smoother tax filing experience.

Get form

The responsibility for generating Schedule K-1 falls to the S corporation itself. This form must be accurately filled out by the corporation to reflect each shareholder's share of income, deductions, and credits. If you are part of an S corporation, the management typically coordinates the production of these forms at the end of the tax year. Should you need any assistance with documentation, platforms like uslegalforms can streamline the process and ensure compliance.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.