Get Irs Instruction 1120s - Schedule K-1 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instruction 1120S - Schedule K-1 online

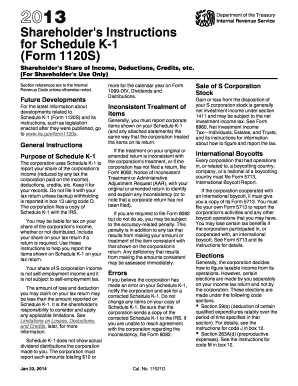

This guide provides clear and supportive instructions for completing the IRS Instruction 1120S - Schedule K-1 online. This form is essential for shareholders of S corporations as it reports their share of income, deductions, and credits from the corporation.

Follow the steps to complete your Schedule K-1 accurately.

- Click the ‘Get Form’ button to access the Schedule K-1 form and open it in your preferred online editor.

- Begin with Part I, which requires you to enter your personal information as the shareholder, including your name, address, and identifying number (SSN or EIN) for accurate reporting.

- Move to Part II to review your share of the corporation's stock and any amounts you invested or loans made to the corporation, which may affect your calculations.

- Proceed to Part III where specific items related to your share of income, deductions, and credits are listed. Ensure to accurately input these amounts as per the corporation's records.

- If there are any adjustments for passive activity or at-risk limitations in relation to income or deductions, document these changes carefully.

- After filling in all relevant sections, double-check your entries for accuracy. It is crucial to ensure that the items you report correspond with how the corporation reported them.

- Once all entries are finalized, save your changes. You can then download, print, or share your completed Schedule K-1 as needed.

Complete your IRS Instruction 1120S - Schedule K-1 online to ensure accurate tax reporting and compliance.

Get form

Distributions are reported in Part III of the IRS Instruction 1120S - Schedule K-1, specifically under the section detailing shareholder distributions. This part helps determine how much is distributed to each shareholder from the S Corp’s profits. Properly allocating these distributions is crucial for both the corporation and the shareholders to understand tax implications. Accurate reporting avoids future compliance issues.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.