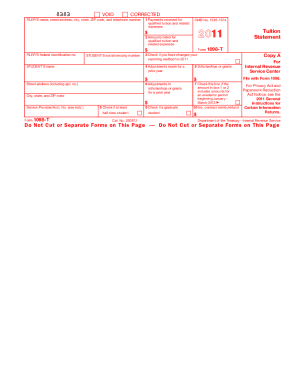

Get Irs 1098-t 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 1098-T online

How to fill out and sign IRS 1098-T online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

If the taxation timeframe commenced unexpectedly or you simply overlooked it, it might likely lead to issues for you. IRS 1098-T is not the easiest form, but you shouldn't be alarmed in any case.

By utilizing our user-friendly service, you will discover the optimal method to complete IRS 1098-T during times of urgent time constraints. All you need to do is adhere to these straightforward instructions:

With our advanced digital solution and its useful tools, completing IRS 1098-T becomes simpler. Don't hesitate to take advantage of it and enjoy more time on hobbies rather than preparing documents.

- Access the document using our robust PDF editor.

- Complete all necessary information in IRS 1098-T, utilizing fillable fields.

- Incorporate graphics, marks, checkboxes, and text boxes, if desired.

- Repetitive information will be populated automatically after the initial entry.

- If you encounter any issues, utilize the Wizard Tool. You will receive helpful hints for easier submission.

- Remember to include the application date.

- Create your personalized e-signature once and apply it to all required fields.

- Review the information you have entered. Rectify errors if needed.

- Click Done to finalize editing and choose your submission method. You will have options for online fax, USPS, or email.

- You can download the document for future printing or upload it to cloud storage such as Google Drive, Dropbox, etc.

How to alter Get IRS 1098-T 2011: personalize forms online

Choose a dependable document editing service you can trust. Edit, execute, and endorse Get IRS 1098-T 2011 securely online.

Frequently, altering forms, such as Get IRS 1098-T 2011, can be troublesome, particularly if they were received in a digital format without access to specialized tools. While there are some alternative methods to navigate this issue, you risk ending up with a form that does not meet the submission criteria. Utilizing a printer and scanner is also impractical as it demands time and resources.

We provide a simpler and more efficient method of modifying forms. A comprehensive assortment of document templates that are easy to adjust and certify, and then make fillable for others. Our solution goes far beyond just a collection of templates. One of the most advantageous features of using our service is that you can modify Get IRS 1098-T 2011 directly on our platform.

Being an online-based service, it eliminates the need for any software installation. Additionally, not all company policies permit you to download it on your work laptop. Here’s how you can conveniently and securely execute your documents with our system.

Bid farewell to paper and other inefficient methods of executing your Get IRS 1098-T 2011 or other forms. Opt for our tool instead, which combines one of the most extensive libraries of ready-to-edit templates with a powerful file editing capability. It's straightforward and secure, and can save you a significant amount of time! Don’t just believe us, try it out for yourself!

- Click the Get Form > you’ll be quickly redirected to our editor.

- Once opened, you can commence the editing procedure.

- Choose checkmark or circle, line, arrow, and cross, along with other options to annotate your document.

- Select the date field to insert a specific date into your template.

- Insert text boxes, images, and notes, among others, to enhance the content.

- Take advantage of the fillable fields option on the right to create fillable {fields.

- Choose Sign from the top toolbar to produce and create your legally-binding signature.

- Click DONE and save, print, and distribute or obtain the output.

Get form

To obtain your IRS 1098-T form from the IRS, you will typically need to rely on your educational institution, as they directly report this form to the IRS. The IRS does not send these forms to taxpayers, so it's best to contact your school. For additional tax-related documents, you might consider using resources like uslegalforms to find solutions tailored for your needs.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.