Loading

Get Irs 990 Or 990-ez - Schedule E 2016

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 990 or 990-EZ - Schedule E online

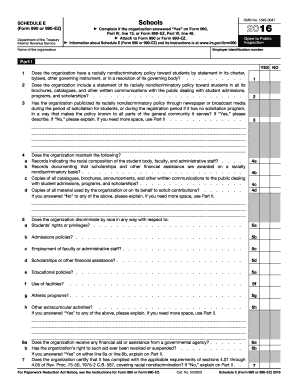

This guide provides clear and user-friendly instructions for completing Schedule E of the IRS Form 990 or 990-EZ online. It is tailored for individuals and organizations who may have little legal experience but need to ensure compliance with IRS requirements regarding nondiscriminatory policies in schools.

Follow the steps to successfully complete Schedule E online.

- Use the ‘Get Form’ button to access the form and open it in your preferred online editor.

- Enter the employer identification number and the name of the organization at the top of the form.

- In Part I, respond to the questions regarding the organization's nondiscriminatory policy. For each question, select 'Yes' or 'No' according to the organization's practices.

- For questions that require explanations (e.g., questions 3, 4d, 5h), make sure to provide complete and clear narratives in Part II of the form as needed.

- If the organization receives governmental aid (question 6a), answer accordingly and provide explanations in Part II if necessary.

- Ensure that an authorized individual certifies compliance with the applicable requirements of nondiscrimination policies by completing line 7.

- Once you have filled out all sections of the form accurately, save your changes. You may choose to download, print, or share the completed form as needed.

Complete your IRS 990 or 990-EZ - Schedule E online today for a streamlined and compliant submission!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Filing the IRS Form 990-EZ electronically is a straightforward process. You can use an authorized e-file provider or software that supports the IRS 990 or 990-EZ – Schedule E. Just ensure you input all required information accurately. Review and submit your form through the chosen platform for a smooth filing experience.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.