Loading

Get Irs 990 Or 990-ez - Schedule E 2015

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 990 or 990-EZ - Schedule E online

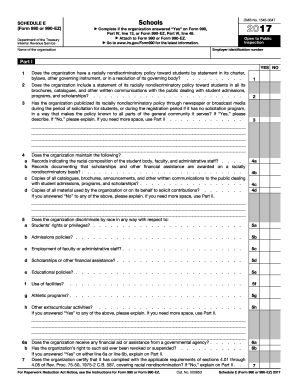

This guide provides a user-friendly, step-by-step approach to completing the IRS 990 or 990-EZ - Schedule E online. You will gain clarity on the various sections and fields of the form, ensuring accurate and compliant submissions.

Follow the steps to fill out Schedule E effectively.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Begin by entering your employer identification number (EIN) and the name of your organization at the top of the form. Ensure that the information matches your official tax filings.

- Move to Part I and answer the initial questions regarding your organization's racially nondiscriminatory policy. For each question (1 through 7), choose 'Yes' or 'No' as appropriate. If answering 'No' to any question, be prepared to provide explanations in Part II.

- In each subsection of Part I, provide any additional information required as prompted. If necessary, utilize Part II for detailed explanations on specific lines where you indicated a 'No' response.

- Review the requirements outlined under sections 4.01 through 4.05 to ensure compliance with the racially nondiscriminatory policy and recordkeeping.

- Once all questions have been answered, double-check your responses for accuracy and completeness. Make sure to align your responses with your organization’s actual policies and practices.

- After finalizing your entries, use the options available to save changes, download, print, or share the form as needed. Ensure that Schedule E is attached to your Form 990 or Form 990-EZ before submission.

Complete your IRS 990 or 990-EZ - Schedule E online today for accurate compliance.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

IRS Form 990-PF is specific to private foundations, while 990-EZ is for smaller public charities. Foundations must report their distributions and activities separately on Form 990-PF. Knowing the distinction helps ensure that your organization follows the correct filing guidelines.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.