Loading

Get Tx 5200 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX 5200 online

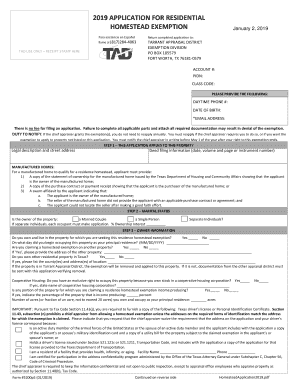

The TX 5200 form is essential for applying for residential homestead exemptions in Texas. This guide will walk you through the process of completing the form online, ensuring that you meet all necessary requirements to receive the exemption benefits.

Follow the steps to fill out the TX 5200 online effectively.

- Click the ‘Get Form’ button to obtain the TX 5200 form and open it in your preferred online editor.

- Begin by entering your contact information. Provide the name of the property owners, their daytime phone number, and the email address. Ensure that all details are accurate and match your identification documents.

- Indicate the marital status and ownership interest, specifying whether the property is owned by married partners or separate individuals. Each occupant must apply individually if necessary.

- Confirm your residency status by answering whether you occupy the property and the date you began living there as your principal residence. Also, indicate if you have claimed a homestead exemption on any other property.

- Provide details about your previous properties, if applicable. List any other residential properties you own and confirm whether the exemption will be removed from any prior property.

- Specify the legal description of the property and the acreage owned. This detail is crucial as exemptions can vary based on property size.

- Select the appropriate exemptions that apply to you by checking the boxes for general residence homestead, age 65 or older, disability, veterans, etc. Ensure you understand the requirements and attach necessary documentation for claimed exemptions.

- Finally, review all provided information for accuracy before signing the application. After all fields are filled out, you can save changes, download a copy for your records, print it, or share it digitally.

Complete your TX 5200 application online today to take advantage of your potential exemptions.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

In Texas, an LLC typically needs to file an annual report along with the franchise tax. The report verifies your business's current existence and compliance with state laws. Regularly checking with the Texas Secretary of State will keep you informed about any changes in requirements. Leveraging the TX 5200 can also provide valuable insights into what is needed for your annual report.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.