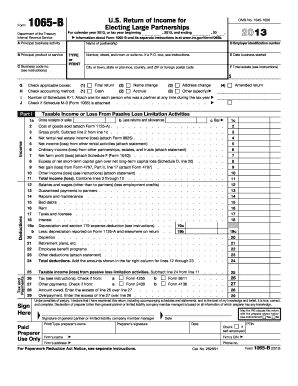

Get Irs 1065-b 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 1065-B online

How to fill out and sign IRS 1065-B online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When the financial reporting period commenced unexpectedly or perhaps you simply overlooked it, it may likely lead to complications for you.

IRS 1065-B is not the simplest form, but you have no reason to worry regardless of the circumstances.

With our comprehensive digital solution and its advantageous features, completing IRS 1065-B becomes more effortless. Do not hesitate to utilize it and enjoy more time for hobbies and interests instead of document preparation.

- Launch the document using our state-of-the-art PDF editor.

- Complete the necessary information in IRS 1065-B, utilizing the fillable fields.

- Incorporate images, check marks, tick boxes, and text boxes as needed.

- Repeated information will auto-fill after the initial entry.

- If you experience any confusion, activate the Wizard Tool. You will receive guidance for easier submission.

- Remember to include the application date.

- Generate your distinctive e-signature once and apply it to all the required fields.

- Review the information you entered. Amend any errors if needed.

- Press Done to complete the editing process and choose your submission method. You have options such as online fax, USPS, or email.

- You may also download the document for later printing or upload it to cloud storage.

How to Alter IRS 1065-B 2013: Personalize Forms Online

Finalizing documents is easier with intelligent online tools. Eliminate paperwork with easily downloadable IRS 1065-B 2013 templates that you can adapt online and print.

Creating documents and paperwork should be more accessible, whether it’s a routine part of a job or occasional tasks. When someone needs to submit an IRS 1065-B 2013, learning about regulations and guides on how to accurately complete a form and what to include can consume significant time and effort. However, if you discover the right IRS 1065-B 2013 template, filling out a document will no longer be difficult with a smart editor available.

Explore a broader array of features you can incorporate into your document management routine. There’s no need to print, fill out, and annotate forms by hand. With an intelligent editing platform, all vital document processing features will always be accessible. If you aim to enhance your workflow with IRS 1065-B 2013 forms, locate the template in the library, click on it, and unveil an easier method to complete it.

The more tools you familiarize yourself with, the easier it becomes to work with IRS 1065-B 2013. Explore the solution that provides everything needed to find and alter forms in a single browser tab and leave behind manual paperwork.

- If you desire to insert text in any section of the form or add a text field, utilize the Text and Text field tools and expand the content in the form as much as necessary.

- Employ the Highlight tool to emphasize the crucial sections of the form. If you wish to obscure or eliminate certain text portions, use the Blackout or Erase instruments.

- Personalize the form by incorporating default graphic elements. Use the Circle, Check, and Cross tools to add these elements to the forms, if needed.

- If you require extra notes, utilize the Sticky note feature and add as many notes to the forms page as necessary.

- In case the form needs your initials or date, the editor also has tools for that. Reduce the risk of mistakes using the Initials and Date instruments.

- You can also insert custom visual elements into the form. Use the Arrow, Line, and Draw tools to modify the document.

Get form

Related links form

A balance sheet is not automatically required when filing IRS 1065-B unless specific conditions apply to your partnership. Larger partnerships or those with significant assets may need to attach it. For accurate advice, consider utilizing resources from US Legal Forms to ensure compliance.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.