Loading

Get Irs 8883 2002

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8883 online

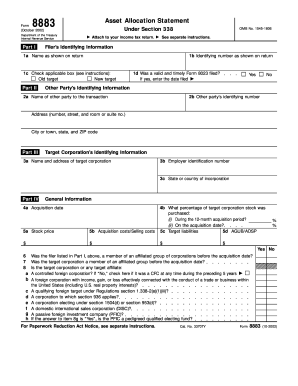

Filling out the IRS Form 8883, known as the Asset Allocation Statement, is essential for individuals involved in certain corporate transactions. This document outlines how to complete the form accurately when submitting it online, ensuring you meet all necessary requirements.

Follow the steps to fill out the IRS 8883 online successfully.

- Press the ‘Get Form’ button to access the form and open it in the editor.

- In Part I, enter your name as it appears on your income tax return and your identifying number. Check the applicable box to specify whether it pertains to an old target or a new target.

- In Part II, indicate whether a valid and timely Form 8023 was filed by selecting 'Yes' or 'No'. If 'Yes', provide the date it was filed.

- Complete the other party’s identifying information in Section 2, including the name and address, and the identifying number of the other party involved in the transaction.

- For Part III, provide the target corporation’s identifying information, including their name, address, and employer identification number.

- In Part IV, fill in the acquisition date, stock price, acquisition costs, selling costs, and the percentage of target corporation stock purchased during the specified periods.

- Respond to the questions in Part IV regarding the affiliations of the filer and the target corporation, checking 'Yes' or 'No' as appropriate.

- Proceed to Part V, where you will complete the original statement of assets transferred. Provide the aggregate fair market value and allocation for each class of assets.

- If applicable, in Part VI, complete the supplemental statement of assets transferred by detailing any increases or decreases in AGUB or ADSP that necessitate amending previous submissions.

- Review all information entered on the form for accuracy. Once confirmed, save your changes, and choose to download, print, or share the completed form as needed.

Take the next step and complete your IRS 8883 online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, your AGI must be accurate on your tax return, as an incorrect AGI can lead to processing delays and potential penalties. The IRS relies on exact data for your tax liability and any potential refunds. Carefully double-checking your calculations and reporting can help prevent errors. For more detailed guidance, consider resources at uslegalforms to ensure everything is filed correctly.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.