Get Irs 8880 2003

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8880 online

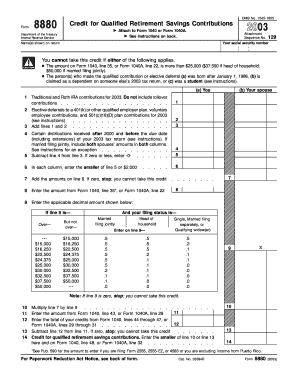

Filling out the IRS Form 8880, which is used to calculate the credit for qualified retirement savings contributions, can be straightforward with the right guidance. This guide will provide step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to fill out the IRS 8880 online.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Enter the name(s) shown on your tax return in the designated field at the top of the form.

- Input your social security number in the field provided. This is crucial for identification.

- Review the eligibility criteria, ensuring that neither you nor your spouse (if filing jointly) meets any of the exclusion clauses listed on the form.

- In Part I, line 1, record your contributions to traditional and Roth IRAs for the current tax year, excluding rollover contributions.

- On line 2, add any elective deferrals to a 401(k) or other qualified employer plans, including voluntary employee contributions and contributions to a 501(c)(18)(D) plan.

- Calculate the total of lines 1 and 2 and enter the sum on line 3.

- Report any distributions received after 2000 and before the due date of your tax return in line 4. Ensure to include only qualifying amounts.

- Subtract the amount on line 4 from line 3 and enter the result on line 5. If this amount is zero or lower, enter -0-.

- For line 6, enter the smaller value of line 5 or $2,000 in each column.

- Sum the total amounts from line 6 in line 7. If the total is zero, you are not eligible for the credit.

- On line 8, input the income amount from either Form 1040, line 35 or Form 1040A, line 22.

- Follow the instructions to enter the appropriate decimal multiplier on line 9 based on your income and filing status.

- Multiply the result from line 7 by the decimal from line 9 and write it on line 10.

- Report the total amount from Form 1040, line 43, or Form 1040A, line 28 in line 11.

- Enter your total credits from Form 1040 in line 12. Subtract line 12 from line 11.

- Finally, enter the smaller amount from line 10 or line 13 on line 14. This is your credit for qualified retirement savings contributions.

- Review all entries for accuracy, then save changes, download, print, or share the form as needed.

Start filing your IRS 8880 online today!

Get form

TurboTax typically inquires about IRS Form 8889 T to assess your health savings account contributions, distinct from Form 8880, which focuses on retirement contributions. Clarifying your contributions across different accounts helps ensure you receive all eligible tax benefits. If you encounter confusion about these forms, reaching out to a tax professional or exploring resources like US Legal Forms can provide clarity and direction tailored to your specific situation.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.