Get Or Dor 150-800-743 2006

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

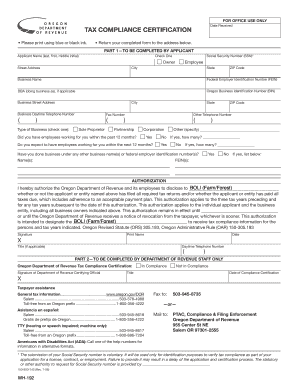

Tips on how to fill out, edit and sign OR DoR 150-800-743 online

How to fill out and sign OR DoR 150-800-743 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Tax form completion can evolve into a major issue and considerable frustration if no suitable help is provided.

US Legal Forms has been developed as an online solution for OR DoR 150-800-743 electronic filing and offers various benefits for taxpayers.

Press the Done button on the upper menu once you have finished it. Save, download, or export the completed document. Use US Legal Forms to ensure secure and straightforward OR DoR 150-800-743 completion.

- Locate the form on the website in the designated section or through the search option.

- Click the orange button to access it and wait for it to load.

- Examine the form and adhere to the provided instructions. If you have not filled out the form before, follow the detailed guidelines.

- Pay attention to the highlighted fields. These are editable and require specific information to be entered. If you are uncertain about what to include, refer to the guidelines.

- Always sign the OR DoR 150-800-743. Utilize the integrated tool to create the e-signature.

- Select the date field to automatically insert the correct date.

- Re-read the form to verify and modify it before submitting electronically.

How to modify Get OR DoR 150-800-743 2006: personalize forms online

Experience the capabilities of the versatile online editor while finalizing your Get OR DoR 150-800-743 2006. Utilize the array of tools to swiftly fill in the gaps and deliver the necessary information immediately.

Creating paperwork is labor-intensive and costly unless you possess pre-made fillable forms and complete them digitally. The easiest approach to handle the Get OR DoR 150-800-743 2006 is to utilize our expert and feature-rich online editing tools. We offer you all the essential resources for efficient form completion and permit you to make any modifications to your templates, tailoring them to any requirements. In addition, you can comment on the modifications and leave annotations for others involved.

Managing the Get OR DoR 150-800-743 2006 in our robust online editor is the fastest and most efficient method to handle, submit, and share your documents as you desire from anywhere. The tool operates from the cloud, allowing you to access it from any location on any internet-enabled device. All templates you create or complete are securely stored in the cloud, so you can always retrieve them when needed and be assured of not misplacing them. Cease spending time on manual document filling and eliminate paper; conduct everything online with minimal effort.

- Fill in the gaps using Text, Cross, Check, Initials, Date, and Sign instruments.

- Emphasize important details with a chosen color or underline them.

- Hide sensitive details with the Blackout feature or simply remove them.

- Insert images to illustrate your Get OR DoR 150-800-743 2006.

- Substitute the original wording with one that fits your requirements.

- Include comments or sticky notes to collaborate with others on the revisions.

- Add extra fillable fields and designate them to particular recipients.

- Secure the template with watermarks, include dates, and bates numbers.

- Distribute the document in various ways and save it on your device or in the cloud in multiple formats after editing.

Get form

Related links form

If you are looking for help with your Oregon tax return, you can reach out to the Oregon Department of Revenue at 150-800-743. This number can connect you with representatives who can assist you with filing processes and any concerns regarding your return. Ensure you're well-informed for a smooth filing experience.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.