Get Irs 1065 - Schedule M-3 Instructions 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 1065 - Schedule M-3 Instructions online

How to fill out and sign IRS 1065 - Schedule M-3 Instructions online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When the tax period commenced unexpectedly or perhaps you simply overlooked it, it might likely pose challenges for you. IRS 1065 - Schedule M-3 Instructions is not the simplest one, but there is no cause for alarm in any case.

Leveraging our robust platform, you will learn how to complete IRS 1065 - Schedule M-3 Instructions in circumstances of significant time constraint. You merely need to adhere to these basic instructions:

With this powerful digital solution and its professional tools, completing IRS 1065 - Schedule M-3 Instructions becomes more manageable. Don't hesitate to utilize it and enjoy more time on leisure activities rather than on document preparation.

Access the document in our robust PDF editor.

Complete the details required in IRS 1065 - Schedule M-3 Instructions, utilizing fillable fields.

Add images, checkmarks, checkbox, and text fields, if applicable.

Recurring fields will be automatically filled after the initial input.

If you encounter any issues, activate the Wizard Tool. You will receive some guidance for smoother completion.

Always remember to include the date of submission.

Create your distinctive e-signature once and place it in all the necessary areas.

Review the information you have entered. Amend errors if needed.

Hit Done to complete editing and choose the method of sending it. You have the option to use virtual fax, USPS, or e-mail.

You can even download the file to print later or upload it to cloud storage such as Google Drive, OneDrive, etc.

How to Modify Obtain IRS 1065 - Schedule M-3 Directions 2017: tailor forms online

Place the appropriate document organization tools at your disposal. Execute Obtain IRS 1065 - Schedule M-3 Directions 2017 with our reliable tool that merges editing and electronic signature capabilities.

If you aim to finalize and validate Obtain IRS 1065 - Schedule M-3 Directions 2017 online effortlessly, then our internet-based cloud solution is the optimal choice. We provide a rich library of template-based forms ready for alteration and completion online. Additionally, you don't need to print the document or utilize external services to make it fillable. All essential tools will be accessible for your use once you launch the document in the editor.

Let’s explore our web-based editing resources and their main features. The editor boasts a user-friendly interface, ensuring you won't need much time to grasp how to use it. We’ll examine three key sections that enable you to:

In addition to the features above, you can secure your document with a password, add a watermark, convert the document to the desired format, and much more.

Our editor simplifies modifying and certifying the Obtain IRS 1065 - Schedule M-3 Directions 2017. It empowers you to accomplish virtually everything regarding form management. Furthermore, we consistently ensure that your document handling experience remains safe and adheres to major regulatory standards. All these elements enhance your enjoyment of our tool.

Obtain Obtain IRS 1065 - Schedule M-3 Directions 2017, make the required edits and modifications, and retrieve it in the preferred file format. Give it a try today!

- Revise and comment on the template

- The upper toolbar includes tools that allow you to emphasize and obscure text, excluding pictures and graphic elements (lines, arrows, and checkmarks, etc.), sign, initial, date the document, and more.

- Arrange your files

- Utilize the toolbar on the left if you want to reorder the form or/and expunge pages.

- Make them accessible to others

- If you wish to render the template fillable for others and share it, you can employ the tools on the right and append various fillable fields, signature and date, text box, etc.

Get form

Related links form

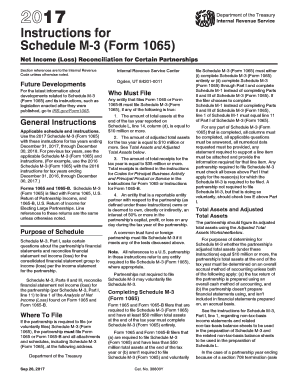

Schedule M(3) is required for S corporations and partnerships that have total assets of $10 million or more. It offers detailed reconciliation of their income items, ensuring transparency and compliance. Understanding the specifics outlined in the IRS 1065 - Schedule M-3 Instructions is essential for fulfilling this requirement.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.