Loading

Get Irs 1065 - Schedule M-3 Instructions 2018

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1065 - Schedule M-3 Instructions online

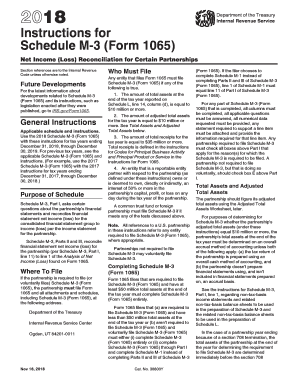

The IRS 1065 - Schedule M-3 is essential for certain partnerships to reconcile their financial statement net income or loss with taxable income. This guide offers a step-by-step approach to help users complete this form online, ensuring clarity and accuracy in their filings.

Follow the steps to fill out the IRS 1065 - Schedule M-3 Instructions online effectively.

- Press the ‘Get Form’ button to access the Schedule M-3 form online and open it for editing.

- Begin with Part I, where you answer questions regarding the type of income statements you prepared, ensuring you refer to your financial statements accurately.

- Fill out the required sections, including total assets, adjusted total assets, and income calculations as applicable. Make sure to check any boxes that apply to your filing requirements.

- Proceed to Parts II and III, where you must reconcile financial statement net income/loss with taxable income/loss. Provide all necessary details and calculations, utilizing the template to ensure proper reporting of temporary and permanent differences.

- For each item reported in Parts II and III, attach any supporting statements required. Ensure that every entry aligns with the descriptions and adjustments outlined in the instructions.

- After completing the form, review all entries for accuracy before saving your changes. Confirm that all sections are filled correctly according to the latest IRS guidelines.

- Once you have verified all information, you can download, print, or share the form as needed. Make sure to follow the submission guidelines specified by the IRS.

Begin completing your IRS 1065 - Schedule M-3 online today for a hassle-free filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Schedule M-3 must be filed by partnerships with total assets exceeding $10 million. Additionally, entities that choose to file for tax years beginning after 2018 must also submit this form. Familiarizing yourself with the IRS 1065 - Schedule M-3 Instructions can provide guidance on whether your partnership falls under this category.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.