Get Irs 8879-pe 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8879-PE online

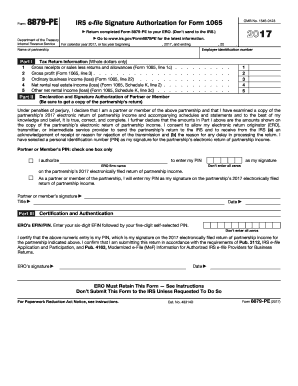

The IRS 8879-PE form is an essential document used by partners or members of a partnership to authorize the electronic filing of a partnership's income tax return. This guide provides clear, step-by-step instructions to assist users in completing the IRS 8879-PE online effectively.

Follow the steps to complete the IRS 8879-PE form online.

- Click the ‘Get Form’ button to obtain the IRS 8879-PE form and open it in your preferred document editor.

- Enter the appropriate tax year information at the top of the form, specifying the beginning and ending dates for the tax year.

- In Part I, input the gross receipts or sales, gross profit, ordinary business income or loss, net rental real estate income or loss, and any other net rental income or loss. Ensure to use whole dollars only.

- Proceed to Part II to declare and authorize your signature as a partner or member. Make sure to read the declaration thoroughly, then indicate your agreement.

- Select your personal identification number (PIN), which you will use as your signature. Ensure this is a unique five-digit number that is not all zeros.

- If authorizing your electronic return originator (ERO) to enter your PIN, ensure you clearly state the ERO's firm name in the designated section.

- Sign the form, input your title, and provide the date in Part II after reviewing all information you have entered.

- Complete Part III by entering your ERO's EFIN and self-selected PIN, ensuring the numeric entry is correct, as it serves as a signature for the partnership's return.

- Once you have filled out the form completely, save your changes. You can then download, print, or share the IRS 8879-PE form as needed.

Start completing your IRS 8879-PE form online today to ensure timely electronic filing of your partnership’s return.

Get form

Form 8453 PE is specifically designed for partners and entities to authenticate and submit their electronic tax returns. This form provides the IRS with the necessary assurances that the return is correctly filed and reflects the entity's financial situation. Utilizing Form 8453 PE helps streamline the filing process for business-related tax returns. In relation to the IRS 8879-PE, both forms ensure accurate reporting and compliance.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.