Loading

Get Vt Lc-142 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VT LC-142 online

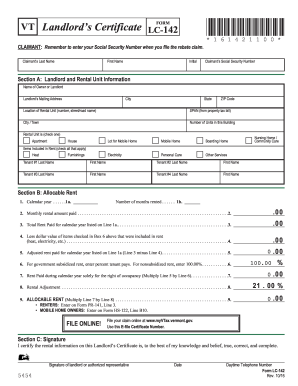

The VT LC-142 is a crucial document for landlords seeking to file a rebate claim in Vermont. This guide will walk you through each section and field of the form, ensuring that you understand how to complete it accurately and efficiently.

Follow the steps to fill out the VT LC-142 online easily.

- Press the ‘Get Form’ button to access the VT LC-142 form and open it in your editor.

- Complete Section A, which includes the landlord and rental unit information. Begin by entering the name of the owner or landlord, followed by the landlord’s mailing address and the city, state, and ZIP code.

- Specify the location of the rental unit by filling in the number and street or road name, as well as the SPAN from the property tax bill and the city or town.

- Indicate the number of units in the building and check the appropriate box that describes the type of rental unit, such as apartment, house, or mobile home.

- In the same section, check all items included in the rent, such as heat, electricity, and furnishings.

- Proceed to Section B: Allocable Rent. Enter the calendar year for which you are filing in Line 1a and the number of months rented in Line 1b.

- For Line 2, input the monthly rental amount paid during the specified calendar year.

- Calculate the total rent paid for the calendar year and write it in Line 3.

- Identify the dollar value of items that were included in rent from Box 6 and enter that amount in Line 4.

- Subtract the dollar value in Line 4 from the total rent in Line 3 to fill out Line 5.

- Indicate the percent of rent paid if government-subsidized rent applies in Line 6, or enter 100.00% for nonsubsidized rent.

- Calculate the rent paid solely for occupancy by multiplying the value in Line 5 by the percentage in Line 6, and enter it in Line 7.

- For Line 8, fill in the rental adjustment, if applicable.

- Finally, calculate the allocable rent by multiplying the amount in Line 7 by the rental adjustment in Line 8, and provide this value in Line 9.

- At the end of the form, in Section C, sign and date it, and enter your daytime telephone number.

- Once you have completed all sections, save your changes, print the form, or share it as needed.

Complete your VT LC-142 form online for a smooth filing experience!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

In Vermont, a guest can become a tenant relatively quickly, often after just one night of continuous stay if they have established residency. Factors such as payment or the intention to remain can influence this status. Understanding the nuances of tenant laws can protect both you and your guests. It's advisable to familiarize yourself with relevant resources and documents like the VT LC-142 to avoid unforeseen complications.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.