Get Cfs Your Personal Budget Plan

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CFS Your Personal Budget Plan online

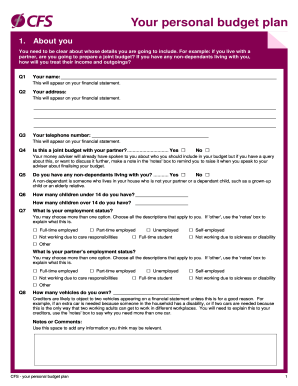

This guide provides detailed instructions on how to complete the CFS Your Personal Budget Plan online. It aims to assist users in compiling their personal budget information accurately and efficiently.

Follow the steps to fill out your personal budget plan seamlessly.

- Press the ‘Get Form’ button to acquire the online form and have it opened in the designated editor.

- Begin with the 'About you' section. Fill in your personal details including your name, address, and telephone number. Indicate whether this is a joint budget and if you have any non-dependants living with you.

- In the 'Your income' section, detail all forms of income. Break it down into categories such as salary, other income, benefits, and pensions. Be as detailed as possible in indicating monthly or weekly amounts.

- Proceed to the 'Your Assets' section. Provide information about your home and any other assets such as vehicles and savings. Be sure to estimate values reasonably.

- Next, fill out the 'Your spending' section. List all essential and non-essential expenditures. Capture all necessary expenses to present a clear picture of your financial obligations.

- Include information on 'Your priority debts'. Document any balances owed on priority payments like rent or utility bills and indicate if repayment arrangements have been made.

- Complete the 'Your non-priority debts' section by outlining any credit-related debts you hold. This includes personal loans or credit card debts.

- Once all sections are filled, review your details for accuracy. After confirming everything is correct, you can save your changes, download, print, or share the form as per your needs.

Start filling out your CFS Your Personal Budget Plan online today to take control of your financial situation.

Filling out a monthly budget sheet requires a clear understanding of your finances. Start by detailing your income sources at the top and follow with a list of your fixed expenses, like rent or utilities, and variable expenses, such as groceries and entertainment. Once you have detailed each category, compare your total income with expenses to see your financial standing. Tools like the CFS Your Personal Budget Plan can simplify this process and help you stay on track.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.