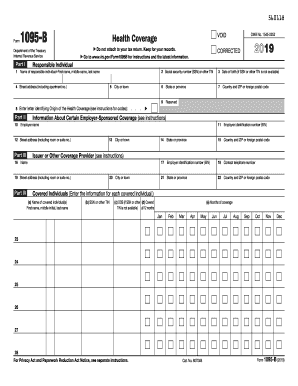

Get Irs 1095-b 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 1095-B online

How to fill out and sign IRS 1095-B online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When the tax period begins unexpectedly or you simply overlooked it, it might create complications for you.

IRS 1095-B is not the easiest form, but there’s no need to panic in any situation.

With this effective digital tool and its beneficial features, filling out IRS 1095-B becomes simpler. Don’t hesitate to give it a try and enjoy more time on hobbies and interests rather than on document preparation.

- Access the document in our robust PDF editor.

- Complete the necessary information in IRS 1095-B, using fillable fields.

- Add images, crosses, checkboxes, and text boxes, if required.

- Repeating fields will be inserted automatically after the initial entry.

- If you encounter any confusion, activate the Wizard Tool. You will find helpful hints for easier completion.

- Remember to include the filing date.

- Create your personalized e-signature once and place it in all necessary locations.

- Review the information you have entered. Amend errors if needed.

- Click on Done to complete the modifications and select the method of submission. You will have the option to use digital fax, USPS, or email.

- Additionally, you can download the document to print it later or upload it to a cloud service like Google Drive, Dropbox, etc.

How to Modify Get IRS 1095-B 2019: Personalize Forms Online

Bid farewell to an old-fashioned paper-centric method of completing Get IRS 1095-B 2019. Get the document filled in and validated in just minutes using our expert online editor.

Are you compelled to update and complete Get IRS 1095-B 2019? With a powerful editor like ours, you can accomplish this in only a few moments without the hassle of printing and scanning papers repeatedly. We offer fully malleable and clear form templates that will act as a foundation and assist you in finishing the necessary form online.

All files automatically feature fillable fields you can utilize as soon as you access the template. However, if you wish to enhance the current content of the document or insert new elements, you can select from an assortment of customization and annotation tools. Emphasize, redact, and provide feedback on the document; add checkmarks, lines, text boxes, graphics, notes, and comments. Furthermore, you can easily certify the template with a legally-recognized signature. The finalized document can be distributed to others, saved, imported to external applications, or formatted into any widely-used format.

You’ll never make a mistake by opting for our web-based solution to process Get IRS 1095-B 2019 because it's:

Don’t squander time altering your Get IRS 1095-B 2019 the antiquated way - with pen and paper. Utilize our feature-rich tool instead. It provides you with a diverse array of editing capabilities, integrated eSignature functionalities, and user-friendliness. What differentiates it is the collaborative features - you can team up on forms with anyone, establish a well-structured document approval process from the beginning, and much more. Explore our online tool and obtain excellent value for your investment!

- Simple to establish and operate, even for users unfamiliar with online document completion.

- Sturdy enough to handle various editing requirements and form categories.

- Safe and secure, ensuring your editing experience is safeguarded every time.

- Accessible across multiple devices, making it easy to finalize the form from nearly any location.

- Able to generate forms based on pre-existing templates.

- Compatible with different document formats: PDF, DOC, DOCX, PPT, and JPEG, etc.

Get form

Yes, including Form IRS 1095-B on your tax return is necessary for compliance. It provides assurance to the IRS that you had qualifying health coverage during the year. While it may not directly affect your refund, it is crucial for fulfilling your tax obligations and avoiding any potential penalties.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.