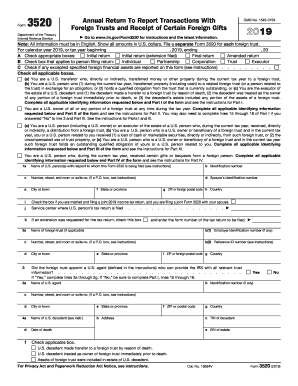

Get Irs 3520 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 3520 online

How to fill out and sign IRS 3520 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When people aren’t linked with document management and legal procedures, completing IRS forms can be quite daunting. We recognize the importance of accurately filling out forms. Our service provides the capability to simplify the process of handling IRS documents as much as possible. Adhere to these instructions to accurately and swiftly complete IRS 3520.

How to fill out the IRS 3520 online:

Using our robust solution can truly turn professional completion of IRS 3520 into a reality. Ensure everything is arranged for your comfort and prompt work.

Press the button Get Form to open it and start editing.

Complete all necessary fields in the document using our expert PDF editor. Activate the Wizard Tool to make the process significantly easier.

Verify the accuracy of the entered information.

Add the date of completing IRS 3520. Utilize the Sign Tool to create a unique signature for the document's validation.

Conclude editing by clicking Done.

Submit this document directly to the IRS in the most convenient way for you: via email, with online fax, or postal service.

You can print it on paper if a hard copy is needed, and download or store it to your preferred cloud storage.

How to modify Get IRS 3520 2019: personalize forms online

Forget the conventional paper-based method of completing Get IRS 3520 2019. Finish and sign the form promptly with our expert online editor.

Are you compelled to alter and finalize Get IRS 3520 2019? With a powerful editor like ours, you can accomplish this task in just a few moments without needing to print and scan documents repeatedly. We offer entirely customizable and user-friendly form templates that will help you finalize the required form online.

All forms, by default, include fillable fields you can complete once you access the template. However, if you want to refine the existing content of the document or insert new information, you can select from a wide range of editing and annotation tools. Highlight, blackout, and comment on the document; add checkmarks, lines, text boxes, images, notes, and comments. Furthermore, you can effortlessly certify the template with a legally-binding signature. The finished document can be shared with others, saved, sent to external applications, or converted into different formats.

You’ll never regret selecting our web-based tool to complete Get IRS 3520 2019 because it's:

Do not waste time filling out your Get IRS 3520 2019 the traditional way - using pen and paper. Opt for our feature-rich solution instead. It offers you a versatile range of editing tools, built-in eSignature capabilities, and convenience. What sets it apart is the team collaboration features - you can collaborate on documents with anyone, create a well-organized document approval process from start to finish, and much more. Try our online solution and receive excellent value for your investment!

- Simple to set up and utilize, even for individuals who haven’t filled out documents online before.

- Strong enough to meet various editing requirements and form types.

- Safe and secure, ensuring your editing experience is protected every time.

- Accessible on different devices, allowing you to complete the form from anywhere.

- Able to generate forms from pre-existing templates.

- Compatible with various file types: PDF, DOC, DOCX, PPT, and JPEG, etc.

Get form

A strong reasonable cause for IRS penalty abatement often involves extenuating circumstances, such as a serious or unexpected medical issue that hindered your ability to file Form 3520 on time. You might also cite reliance on incorrect advice from a tax professional. Provide evidence of your situation to the IRS to establish your case. For further assistance in this matter, consider using USLegalForms, which can provide you with valuable guidance.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.