Loading

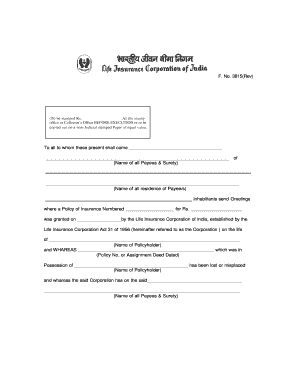

Get In Form 3815

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IN Form 3815 online

Filling out the IN Form 3815 online can simplify the process of submitting your insurance documentation. This guide will provide you with clear, step-by-step instructions to ensure that you complete the form accurately and efficiently.

Follow the steps to complete the IN Form 3815 online.

- Click the ‘Get Form’ button to obtain the form and open it for editing.

- In the first section, enter the names of all payees and the surety in the designated fields. Ensure that the names are accurate and complete.

- Next, provide the full addresses of all payees in the specified area to maintain clear records of the individuals involved.

- Input the insurance policy number where indicated, along with the monetary amount it was granted for. Pay close attention to details to prevent discrepancies.

- Record the date the insurance policy was issued in the respective space. This is important to establish the validity and timeline of the policy.

- If the policy was lost or misplaced, mention the name of the policyholder and the assignment deed, if applicable, in the following section.

- Confirm the party that the Corporation has agreed to pay and includes their names accurately once more.

- In the signature section, all payees and the surety must sign and date the document to validate it.

- Designate a witness to sign the form, and ensure they fill in their designation and address correctly.

- Finally, review the completed form for any errors or omissions, save your changes, and choose to download, print, or share the form as needed.

Complete your documents online today for a quick and hassle-free submission.

Related links form

The FTB can levy your bank account multiple times if debts remain unpaid and they follow proper procedure. Typically, this action can be repeated until the debt is resolved. If your obligations involve an IN Form 3815, it is essential to stay up to date to avoid facing potential levies.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.