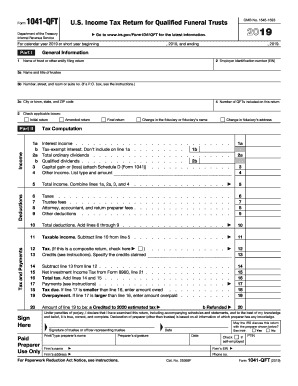

Get Irs 1041-qft 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 1041-QFT online

How to fill out and sign IRS 1041-QFT online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When the taxation period commenced unexpectedly or perhaps you simply overlooked it, it could likely lead to complications for you. IRS 1041-QFT is not the most straightforward form, but there is no need for concern in any event.

Using our user-friendly platform, you will discover how to complete IRS 1041-QFT in instances of significant time shortage. You just need to adhere to these easy guidelines:

With this comprehensive digital solution and its valuable features, completing IRS 1041-QFT becomes more efficient. Do not hesitate to try it out and allocate more time on hobbies and interests instead of document preparation.

Open the document with our sophisticated PDF editor.

Input the necessary information in IRS 1041-QFT, making use of fillable fields.

Add images, marks, check and text boxes, if required.

Duplicate information will be populated automatically after the initial entry.

If you encounter any issues, utilize the Wizard Tool. You will receive suggestions for smoother completion.

Always remember to include the date of submission.

Create your distinctive signature once and apply it to all necessary fields.

Review the information you have entered. Amend errors if needed.

Hit Done to finalize editing and choose how you will transmit it. There is an option to use digital fax, USPS or email.

You can download the document to print it later or upload it to cloud services like Google Drive, Dropbox, etc.

How to Modify Get IRS 1041-QFT 2019: Personalize Forms Online

Utilize our extensive online document editor while finalizing your forms. Finalize the Get IRS 1041-QFT 2019, highlight the crucial details, and effortlessly make any additional alterations to its content.

Filling out documents digitally is not only efficient but also allows you to adjust the template to meet your needs. If you're set to handle the Get IRS 1041-QFT 2019, consider completing it with our all-inclusive online editing tools. Whether you commit a typographical error or input the requested information in the incorrect section, you can promptly modify the form without needing to restart it from the beginning as you would during manual entry.

Additionally, you can emphasize the vital information in your document by highlighting specific pieces of content with colors, underlining them, or enclosing them in circles.

Our powerful online solutions are the easiest method to complete and alter Get IRS 1041-QFT 2019 according to your preferences. Use it to create personal or business documents from any location. Open it in a web browser, make any modifications to your documents, and access them at any time in the future - they will all be securely stored in the cloud.

- Access the file in the editor.

- Enter the necessary information in the blank fields using Text, Check, and Cross instruments.

- Follow the document layout to ensure you don't overlook any critical fields in the template.

- Circle some of the key details and add a URL to it if necessary.

- Utilize the Highlight or Line tools to underscore the most significant pieces of content.

- Select colors and thickness for these lines to give your document a professional appearance.

- Erase or blackout the information you want to keep hidden from others.

- Replace sections of content that contain mistakes and input the text you require.

- Conclude editing with the Done option when you're sure that everything is accurate in the document.

Get form

Related links form

You report beneficiary distributions on IRS Form 1041 in specific fields designated for that purpose. Look for the section that discusses distributions to beneficiaries, typically on Schedule K-1 as well. Accurate reporting is essential for compliance and can ensure that your beneficiaries receive the correct tax documentation. Resources like U.S. Legal Forms guide you through this reporting effectively.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.