Loading

Get Va Form Rdc 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA Form RDC online

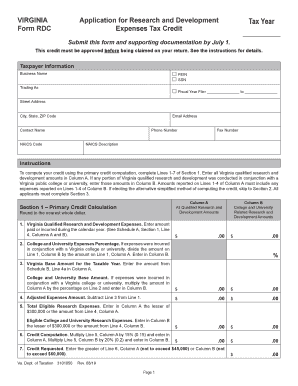

Completing the VA Form RDC is essential for claiming the Research and Development Expenses Tax Credit in Virginia. This guide will provide clear, step-by-step instructions to help users efficiently fill out the form online.

Follow the steps to accurately complete the VA Form RDC online.

- Press the ‘Get Form’ button to access the form and open it in your preferred editing tool.

- Begin with the Taxpayer Information section. Fill in your business name, FEIN, SSN, trading name, and fiscal year dates. Complete the street address, city, state, ZIP code, email address, contact name, NAICS code, phone number, and fax number.

- Proceed to Section 1 – Primary Credit Calculation. Enter Virginia qualified research and development expenses in Column A and any applicable college or university amounts in Column B. Ensure to include figures from Lines 1-4 accurately.

- If electing the alternative simplified method, move to Section 2. Here, provide total adjusted calendar year qualified research and development expenses, ensuring accurate entry in both columns.

- In Section 3 – Credit Information, enter the number of full-time employees, total gross receipts, and any applicable research partner details. Provide information on previous credits received and research field. Complete the description and summary of research projects.

- Review all entries for accuracy. Save changes to your form. Users can then download, print, or share the completed VA Form RDC as needed.

Complete your VA Form RDC online today to ensure your claim for the Research and Development Expenses Tax Credit is accurately submitted.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The amount you can receive back for an R&D tax credit varies based on your expenses and the applicable tax laws. Generally, businesses can receive credits equal to a percentage of their qualifying R&D expenditures. To maximize your benefits, utilize the VA Form RDC as your guide for eligible expenses.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.