Loading

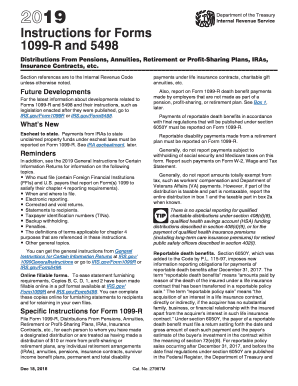

Get Irs Instruction 1099-r & 5498 2019

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the IRS Instruction 1099-R & 5498 online

This guide provides a professional and clear step-by-step approach to electronically completing the IRS Instruction forms 1099-R and 5498. Whether you are unfamiliar with tax forms or have experience, this guide is designed to support your needs throughout the process.

Follow the steps to successfully complete the IRS Instruction forms 1099-R and 5498.

- Press the ‘Get Form’ button to obtain the form and open it in your chosen editor.

- Identify the correct form to fill out. Form 1099-R is for reporting distributions from pensions, annuities, retirement plans, or IRAs. Form 5498 is used for reporting contributions to IRAs. Make sure you have both forms available.

- Begin with Form 1099-R. In Box 1, enter the gross distribution amount paid to the individual. This amount should not include any deductions but reflect the total before taxes.

- Now proceed to Form 5498. In Box 1, report all contributions to traditional IRAs made during the year. This box should contain contributions made up to April 15 of the following year.

- After reviewing all information for accuracy, save your changes. You can download the completed forms, print them for your records, or share them as required.

Complete your IRS documents online efficiently and accurately!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Even if the 1099-R indicates a taxable amount of zero, you still must report it on your tax return. The IRS requires all distributions to be reported to maintain transparency. Check IRS Instruction 1099-R & 5498 to ensure you meet all reporting requirements accurately, thus avoiding potential issues with the IRS.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.