Get Irs 1065 - Schedule D 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1065 - Schedule D online

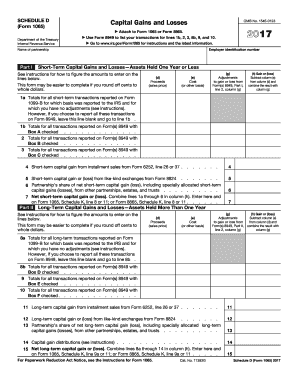

Filling out the IRS 1065 - Schedule D can be a straightforward process when you know how to approach it. This guide provides step-by-step instructions for completing this form online, ensuring you accurately report your partnership's capital gains and losses.

Follow the steps to complete the IRS 1065 - Schedule D online.

- Click 'Get Form' button to access the IRS 1065 - Schedule D and open it for completion.

- Begin with Part I, which covers short-term capital gains and losses for assets held for one year or less. Refer to the instructions if you need guidance on how to determine the amounts to enter for each line.

- In line 1a, if applicable, enter totals for all short-term transactions reported on Form 1099-B without adjustments. If you prefer to report these transactions on Form 8949, leave this line blank and proceed to line 1b.

- In line 1b, report totals for all transactions from Form(s) 8949 where Box A is checked. Follow similar steps for lines 2 and 3 for transactions from Boxes B and C respectively.

- Continue to lines 4 through 6 to report any further short-term capital gains or losses from installment sales, like-kind exchanges, and other partnerships.

- For Part II, turn to long-term capital gains and losses for assets held for more than one year. Again, refer to instructions for entering the amounts correctly.

- In line 8a, report totals for long-term transactions similar to line 1a. If using Form 8949, leave this line blank and move to line 8b.

- Enter totals for transactions on Forms 8949 with Box D, E, and F checked in lines 8b, 9, and 10 respectively.

- Complete lines 11 through 15 for long-term capital gain from installment sales, like-kind exchanges, and capital gain distributions.

- Once all sections are filled out, finalize your document by saving changes, downloading, printing, or sharing the completed form.

Complete your IRS 1065 - Schedule D online today and ensure accurate reporting of your partnership's capital gains and losses.

Get form

Related links form

For an LLC that operates as a partnership, IRS 1065 - Schedule D is used to report capital gains and losses from sales of capital assets. This includes the sale of property, stocks, and other investments by the LLC. Each member needs to consider their share of gains and losses as reported on Schedule D for their individual tax filings. Utilizing platforms like uslegalforms can provide clarity on filling out this schedule correctly.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.