Loading

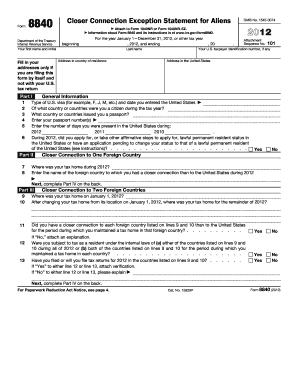

Get Irs 8840 2012

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8840 online

Completing IRS Form 8840 is essential for individuals claiming a closer connection to a foreign country under U.S. tax law. This guide provides step-by-step instructions to help users accurately fill out the form online, ensuring compliance with IRS requirements.

Follow the steps to effectively complete Form 8840 online.

- Press the ‘Get Form’ button to access the form, allowing you to fill it out in a user-friendly online environment.

- Enter your first name and initial, followed by your last name in the designated fields.

- Provide your address in your country of residence. Only complete this field if you are filing the form by itself and not alongside your U.S. tax return.

- Fill in the year you are filing for, which could be for January 1—December 31, 2012, or any other relevant tax year.

- Include your U.S. taxpayer identification number, if available.

- Input your U.S. address in the designated field, if applicable.

- Indicate the type of U.S. visa you hold and the date you entered the United States.

- List all countries where you held citizenship during the tax year.

- Enter the passport number(s) you used during your stay.

- Document the number of days you were present in the United States for the years 2012, 2011, and 2010.

- Answer whether you applied for lawful permanent resident status in the United States during 2012.

- For Part II, specify your tax home location and the foreign country with which you had a closer connection than the United States.

- Complete Part III by detailing your tax homes and connections to the foreign countries listed.

- Move to Part IV, detailing your significant contacts with the foreign country or countries.

- After filling out all sections, review your entries for accuracy.

- Once satisfied, save the changes you made, and download a copy of the form for your records.

- You can then print or share the completed form as needed.

Start filling out your IRS 8840 online today to ensure compliance and avoid potential penalties.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

It is advisable to include your return address on your IRS tax return envelope to facilitate communication should any issues arise with your submission. This ensures that the IRS can easily return any correspondence to you if needed. Including your return address when sending Form 8840 helps streamline the process.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.