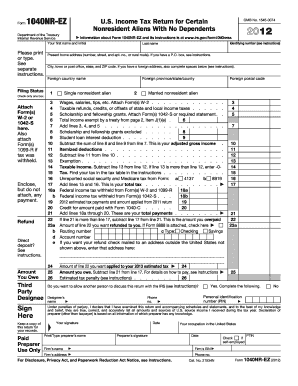

Get Irs 1040nr-ez 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 1040NR-EZ online

How to fill out and sign IRS 1040NR-EZ online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

If the tax period commenced unexpectedly or perhaps you simply overlooked it, it might lead to difficulties for you. IRS 1040NR-EZ is not the simplest form, but you have no cause for concern in any situation.

By using our user-friendly solution, you will learn the correct method to complete IRS 1040NR-EZ in instances of significant time constraints. All you need to do is adhere to these straightforward guidelines:

With our comprehensive digital solution and its professional tools, completing IRS 1040NR-EZ becomes more efficient. Don’t hesitate to try it and have additional time for hobbies instead of document preparation.

Access the document using our robust PDF editor.

Enter the necessary information in IRS 1040NR-EZ, utilizing the fillable fields.

Insert images, checkmarks, tick boxes, and text fields as needed.

Repeated details will be filled automatically after the initial entry.

If you encounter any issues, activate the Wizard Tool. You will receive hints for easier completion.

Remember to include the application date.

Create your exclusive e-signature once and place it in all required areas.

Review the information you have provided. Rectify errors if necessary.

Click on Done to complete the modifications and choose how you wish to submit it. You can opt for digital fax, USPS, or email.

It is possible to download the document to print it later or upload it to cloud storage services like Dropbox, OneDrive, etc.

How to Edit Get IRS 1040NR-EZ 2012: Personalize Forms Online

Utilize our sophisticated editor to transform a basic online template into a finalized document. Continue reading to discover how to alter Get IRS 1040NR-EZ 2012 online effortlessly.

Once you find an ideal Get IRS 1040NR-EZ 2012, all you need to do is modify the template to suit your preferences or legal obligations. Besides filling in the editable form with precise information, you may need to remove certain clauses in the document that are not applicable to your situation. Conversely, you might wish to incorporate any absent conditions in the original template. Our advanced document editing tools are the optimal method to amend and refine the form.

The editor allows you to modify the content of any form, even if the document is in PDF format. You can include and eliminate text, add fillable fields, and make additional modifications while preserving the original formatting of the document. Additionally, you can rearrange the layout of the document by adjusting the page order.

You don’t need to print the Get IRS 1040NR-EZ 2012 to endorse it. The editor includes electronic signature capabilities. Most forms already have signature fields pre-existing. Therefore, you just need to affix your signature and request one from another signing participant with a few clicks.

Follow this step-by-step procedure to generate your Get IRS 1040NR-EZ 2012:

After all parties have signed the document, you will receive a signed copy which you can download, print, and share with others.

Our solutions allow you to save significant time and minimize the likelihood of errors in your documents. Enhance your document workflows with effective editing tools and a robust eSignature solution.

- Open the selected template.

- Use the toolbar to customize the form to your liking.

- Fill out the form with accurate details.

- Click on the signature field and add your eSignature.

- Send the document for signature to additional signers if needed.

Get form

Related links form

IRS Form 1023 and 1023EZ serve different purposes in establishing 501(c)(3) status, with 1023 being more detailed. The 1023EZ is a streamlined version designed for smaller organizations seeking tax-exempt status with less complexity. If you are unsure which form to use, consult uslegalforms for professional advice on completing the necessary paperwork for your organization.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.