Loading

Get Irs 5305-s 2016

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 5305-S online

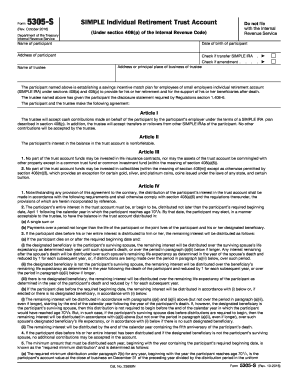

Filling out the IRS 5305-S form online is an essential step for individuals looking to establish a SIMPLE Individual Retirement Account (IRA). This guide provides clear instructions on each section and field to ensure a smooth completion process.

Follow the steps to fill out the IRS 5305-S form online.

- Press the ‘Get Form’ button to access the IRS 5305-S form, allowing you to open it for editing.

- Enter the name of the participant in the designated field. This should be the person establishing the SIMPLE IRA.

- Input the date of birth of the participant. Ensure that the format is correct to avoid any discrepancies.

- Fill in the address of the participant, including street, city, state, and ZIP code.

- Check the box if the SIMPLE IRA is a transfer SIMPLE IRA, and indicate if this form also serves as an amendment.

- Provide the name of the trustee. This must be a bank, savings association, or an IRS-approved custodian.

- Enter the address or principal place of business of the trustee.

- Review Articles I through VIII. These sections outline the specific agreements and regulations governing the SIMPLE IRA.

- Obtain the required signatures. The participant must sign and date the form, and if applicable, indicate any individual signing on their behalf.

- If necessary, have a witness sign the form. This is only required if specified by the participant or trustee's conditions.

- Once all fields are correctly filled out, save the changes. You can download, print, or share the completed form as needed.

Complete your IRS 5305-S form online today to get started with your retirement savings.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To obtain an IRS SS-4 EIN assignment letter, you will need to fill out Form SS-4 to apply for an Employer Identification Number (EIN). Once the IRS processes your application, they will send you the EIN assignment letter, confirming your EIN. Utilizing the US Legal Forms platform can streamline this process, offering resources and guidance to help you complete the paperwork accurately and efficiently.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.