Get Irs 5305-s 2002

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 5305-S online

How to fill out and sign IRS 5305-S online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

If you're not familiar with document management and legal processes, submitting IRS forms can be rather stressful. We recognize the significance of accurately completing forms. Our platform provides the ideal solution to simplify the process of handling IRS documents.

Follow these instructions to accurately and swiftly complete IRS 5305-S.

Using our online software can indeed turn proficient filling of IRS 5305-S into a reality, making everything convenient and straightforward for you.

- Click the button Get Form to open it and start editing.

- Complete all required fields in the chosen document using our efficient and user-friendly PDF editor. Activate the Wizard Tool to make the process even easier.

- Verify the accuracy of the filled information.

- Include the date of completion for IRS 5305-S. Utilize the Sign Tool to create a unique signature for document validation.

- Conclude editing by clicking on Done.

- Send this document directly to the IRS using the method that suits you best: via email, through virtual fax, or by postal service.

- You may print it out on paper if a hard copy is necessary and download or save it to your preferred cloud storage.

How to alter Get IRS 5305-S 2002: personalize forms online

Put the suitable document editing tools at your disposal. Finalize Get IRS 5305-S 2002 with our dependable solution that merges editing and eSignature features.

If you wish to finalize and validate Get IRS 5305-S 2002 online without hassle, then our online cloud-based alternative is the ideal choice. We offer a comprehensive template-based library of ready-to-use documents you can alter and complete online.

Additionally, there’s no need to print the form or use external options to make it fillable. All the essential tools will be at your fingertips once you access the document in the editor.

Beyond the features mentioned above, you can protect your document with a password, incorporate a watermark, convert the file to the specified format, and much more.

Our editor simplifies altering and certifying the Get IRS 5305-S 2002. It empowers you to do nearly everything related to managing forms.

Moreover, we consistently ensure that your experience editing files is secure and in compliance with the primary regulatory standards. All these aspects enhance the enjoyment of utilizing our solution. Obtain Get IRS 5305-S 2002, make the necessary modifications and adjustments, and download it in your preferred file format. Give it a try today!

- Modify and annotate the template

- The top toolbar is equipped with instruments that assist you in highlighting and concealing text, excluding images and graphics (lines, arrows, and checkmarks, etc.), affixing your signature, initializing, dating the form, and more.

- Organize your paperwork

- Utilize the toolbar on the left if you wish to rearrange the form or delete pages.

- Make them shareable

- If you desire to make the document fillable for others and share it, you can utilize the tools on the right to add various fillable fields, signature and date, text box, etc.

Get form

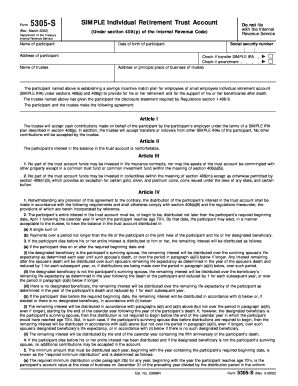

Filling out the 5305 SEP involves providing essential information about your business and the retirement plan. You must complete sections regarding employer details and specify the contribution amounts and methods. For thorough and efficient assistance, consider using US Legal Forms, which can guide you through the entire process, ensuring compliance with IRS 5305-S.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.