Loading

Get Irs 1040-pr 2016

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040-PR online

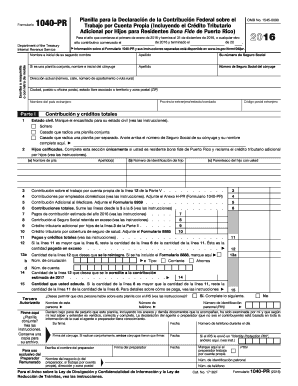

The IRS 1040-PR is a vital form for individuals in Puerto Rico to report their self-employment income and claim applicable tax credits. This guide provides a clear and structured approach to filling out the form online, ensuring a smooth and accurate filing process.

Follow the steps to complete the IRS 1040-PR effectively.

- Press the ‘Get Form’ button to access the IRS 1040-PR and open it in your chosen editor.

- Fill in your name, initial, and last name along with your Social Security number at the top of the form. If you are filing jointly, also provide your partner's name and Social Security number.

- Enter your current address details, including street number, apartment or rural route number, city or town, territory, and ZIP code.

- Indicate your marital status by checking the appropriate box. Options include 'Single,' 'Married filing jointly,' or 'Married filing separately.'

- If claiming the additional child tax credit, fill in the section about qualifying children. Include their names, identification numbers, and relationship to you.

- Complete the sections on total contributions and credits, which outline contributions for self-employment and employee benefits.

- Report estimated payments and any excess Social Security retained. Calculate the total payments and credits based on provided instructions.

- When all fields are completed, review the document for accuracy, and follow the instructions for any additional forms you need to attach.

- Save your changes, download a copy of the completed form, print it, or share it as necessary according to your filing needs.

Begin the process of filling out the IRS 1040-PR online to ensure timely and accurate submission.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

In Puerto Rico, you typically do not file the IRS 1040; instead, you use IRS 1040-PR for Puerto Rican residents. This form considers the specific tax laws applicable in Puerto Rico. However, understanding when and how to file is pivotal to maintaining compliance. You can find valuable guidance through services provided by US Legal Forms to assist with your filing.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.