Loading

Get 2006 1040ez Fill In Form 2006

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2006 1040ez Fill In Form online

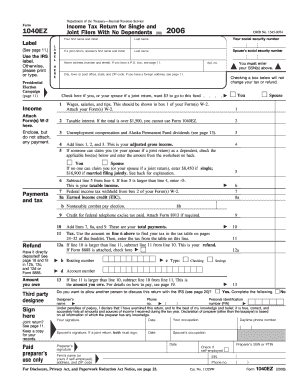

Filling out the 2006 1040ez Fill In Form online can streamline your tax filing process. This guide provides clear, step-by-step instructions to help users of all experience levels complete the form accurately.

Follow the steps to complete the 2006 1040ez Fill In Form online

- Press the ‘Get Form’ button to access the form and open it in your online editor.

- In the first section, fill in your first name, initial, last name, and social security number. If filing jointly, enter your partner’s information as well.

- Provide your home address, including apartment number if applicable. Enter your city, state, and ZIP code.

- Decide whether you would like to contribute $3 to the Presidential Election Campaign by checking the appropriate box.

- Report your total income. Attach Form(s) W-2 if applicable, and enter the total wages, salaries, and tips from box 1.

- If applicable, include any taxable interest or unemployment compensation, and add these amounts to find your adjusted gross income.

- If you cannot be claimed as a dependent, enter the standard deduction amount based on your filing status and complete the calculations for taxable income.

- Complete the payments and tax sections by entering the federal income tax withheld and any applicable credits before calculating your total payments.

- Determine whether you are due a refund or owe an amount. If due a refund, consider opting for direct deposit by providing your bank account information.

- Sign and date the form. If filing jointly, your partner must also sign. Make sure to review the form for accuracy.

- Finally, save any changes made to the form. You may then download, print, or share the completed form as needed.

Start completing your 2006 1040ez Fill In Form online today to ensure a smooth tax filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

You can obtain the IRS form 1040EZ directly from the IRS website or by visiting your local tax office. While this form is no longer in use, past versions, including the 2006 1040ez Fill In Form, are available for reference and educational purposes.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.