Loading

Get Irs 1040-ez 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

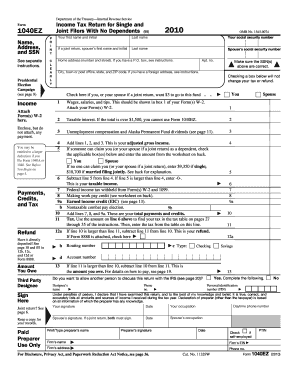

How to fill out the IRS 1040-EZ online

Filing your taxes can be a straightforward process, especially when using the IRS 1040-EZ form. This guide is designed to help you understand and complete the form online effectively.

Follow the steps to successfully complete your IRS 1040-EZ online.

- Press the ‘Get Form’ button to access the IRS 1040-EZ form and open it for editing.

- Enter your personal information in the designated fields. This includes your name, address, and Social Security number. If filing jointly, also include your spouse's details.

- Report your income by filling out lines 1 through 3. Be sure to add your total income together, which includes wages, interest, and any other qualifying income.

- Complete line 5 by considering if anyone can claim you or your spouse as a dependent. Use the worksheet provided on the back of the form to calculate the correct deduction based on your situation.

- Calculate your taxable income by subtracting line 5 from line 4, entering the result onto line 6.

- Fill in lines 7 through 10 with any tax withheld and applicable credits, such as the earned income credit, ensuring all values correspond to your financial documents.

- Determine if you are entitled to a refund or if you owe taxes. Compute this by reviewing the amounts on lines 11 and 12.

- If you would like your refund directly deposited, complete lines 12b, 12c, and 12d with your banking information.

- Sign and date the return, ensuring that both you and your spouse (if filing jointly) provide signatures. Include your daytime phone number and occupation.

- Review all entries for accuracy before saving your changes. You can then download, print, or share the completed form as needed.

Start filling out the IRS 1040-EZ online today to ensure a smooth and timely submission of your tax return.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The federal IRS 1040-EZ form was a simplified tax return option for individuals with basic income reporting needs. It allowed eligible taxpayers to provide essential information without the complexities of other forms. Though it has been replaced by the new 1040 format, understanding the 1040-EZ's purpose helps shed light on how tax preparation has evolved, simplifying processes for millions.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.