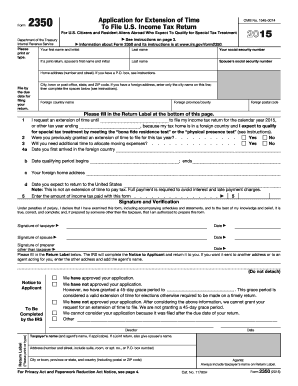

Get Irs 2350 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 2350 online

How to fill out and sign IRS 2350 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

If you aren't linked with document handling and legal procedures, filling out IRS forms appears daunting. We completely understand the significance of accurately completing forms.

Our online application offers a way to simplify the process of submitting IRS forms as straightforward as possible.

Utilizing our platform can truly turn professional filing of IRS 2350 into a reality. We will do everything possible for your convenience and ease.

- Click on the button Get Form to access it and start editing.

- Complete all required fields in the document using our user-friendly PDF editor. Activate the Wizard Tool to make the procedure much simpler.

- Verify the accuracy of the information entered.

- Include the submission date for IRS 2350. Use the Sign Tool to create your unique signature for document validation.

- Conclude editing by selecting Done.

- Send this document to the IRS through the most convenient method for you: via email, digital fax, or postal service.

- You can print a copy when needed and download or save it to your preferred cloud storage.

How to Revise Get IRS 2350 2015: Personalize Forms Online

Bid farewell to a conventional paper-based approach for handling Get IRS 2350 2015. Complete and sign the form in just minutes using our premium online editor.

Are you finding it difficult to modify and finalize Get IRS 2350 2015? With a powerful editor like ours, you can do this in merely minutes without needing to print and rescan documents repeatedly. We provide fully adaptable and user-friendly form templates that serve as a starting point to help you finish the required form online.

All documents, automatically, come with fillable fields that you can interact with immediately upon opening the file. However, if you wish to refine the current content of the form or incorporate new details, you can select from a variety of customization and annotation tools. Emphasize, obscure, and comment on the text; add checkmarks, lines, text boxes, graphics, notes, and comments. Furthermore, you can effortlessly validate the document with a legally-recognized signature. The finalized form can be shared with others, stored, imported into third-party applications, or converted into any common format.

You'll never regret using our web-based solution to process Get IRS 2350 2015 because it's:

Don't waste time amending your Get IRS 2350 2015 the traditional way - with pen and paper. Utilize our feature-rich tool instead. It offers you a versatile array of editing resources, integrated eSignature capabilities, and seamless convenience. What makes it exceptional is the team collaboration features - you can collaborate on documents with anyone, establish an organized document approval workflow from scratch, and much more. Explore our online solution and achieve the best value for your investment!

- Simple to set up and operate, even for individuals who have not filled out documents electronically before.

- Robust enough to accommodate various editing requirements and form varieties.

- Secure and protected, ensuring your editing experience is safeguarded at all times.

- Accessible on multiple devices, allowing you to conveniently complete the form from anywhere.

- Able to generate forms based on pre-existing templates.

- Compatible with numerous file formats: PDF, DOC, DOCX, PPT, and JPEG, etc.

Get form

Related links form

IRS Form 2350 is specifically designed for individuals who need extra time to file their tax returns while overseas. This form allows you to request an extension if you are a U.S. citizen or resident alien living outside the United States. It's important to file this form accurately to avoid penalties for late submission. Utilizing resources like USLegalForms can simplify the process for you.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.